Market Trends

Key Emerging Trends in the Drone Sensor Market

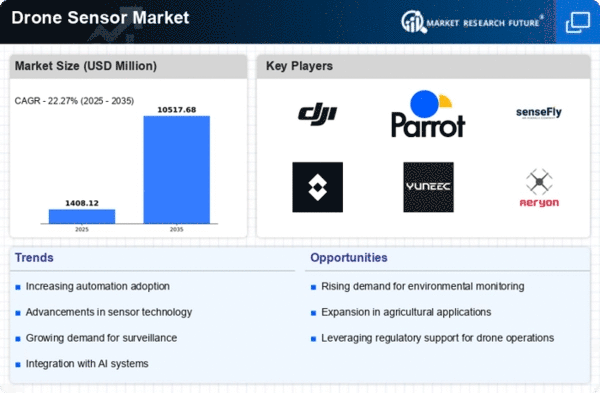

The Drone Sensor Market is witnessing several noteworthy traits that are shaping its panorama and influencing the industry's trajectory. One distinguished trend is the increasing integration of superior imaging technology in drone sensors. High-decision cameras, thermal imaging sensors, and multispectral sensors have become not unusual, allowing drones to capture extra designated and specialized information. The trend in the direction of miniaturization is also shaping the Drone Sensor market. Advances in the sensor era are allowing the development of smaller and lighter sensors without compromising performance. This miniaturization trend allows for extra compact and agile drones, making them suitable for packages in confined areas, indoor environments, and different eventualities in which maneuverability is critical. Miniaturized sensors are contributing to the versatility and accessibility of drone technology. The increasing use of artificial intelligence (AI) and machine learning (ML) in drone sensors is a transformative development. AI and ML algorithms beautify the information processing competencies of Drone Sensors, enabling actual-time evaluation and decision-making. This trend is especially relevant in programs together with automated inspection, surveillance, and item reputation. Energy performance and extended flight times are rising tendencies inside the Drone Sensor marketplace. Companies are specializing in developing energy-efficient sensors and drone structures to lengthen flight durations. This fashion is important for packages that include aerial monitoring, where longer flight instances translate to multiplied insurance and data series abilities. Advances in battery technology and strength control contribute to the trend of optimizing power performance in drone sensor systems. One noteworthy fashion is the growing adoption of Drone Sensor swarming technology. Swarming entails coordinating more than one drone to paint together seamlessly, regularly ready with numerous sensors to cover massive regions efficiently. This trend is gaining traction in packages like agriculture, in which swarms of drones can survey huge fields unexpectedly. The swarming era complements the scalability and effectiveness of drone sensor deployments, opening up new possibilities for collaborative record series. Environmental sustainability is becoming more and more important in the Drone Sensor marketplace. Manufacturers specialize in developing eco-friendly drone systems with reduced environmental effects. This consists of designing sensors with decreased power intake, the use of recyclable substances, and enforcing sustainable manufacturing practices. As environmental consciousness grows, the trend toward a sustainable drone era aligns with broader enterprise and purchaser options.

Leave a Comment