Market Analysis

In-depth Analysis of Drone Sensor Market Industry Landscape

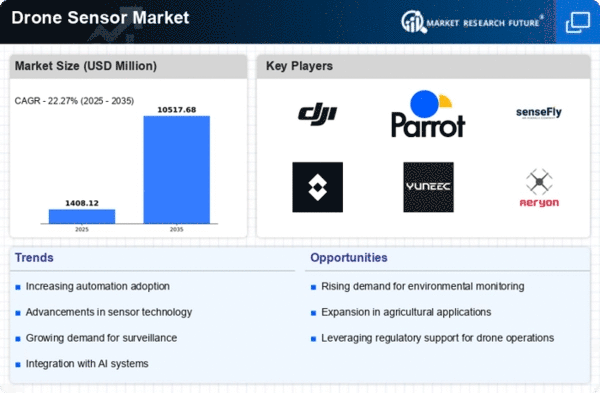

The dynamics of the Drone Sensor Market are shaped by a mess of factors that together impact its growth, developments, and overall trajectory. One essential dynamic is the growing demand for Drone Sensors throughout numerous industries. As drones turn out to be essential to applications together with agriculture, surveillance, and infrastructure inspection, the want for superior sensors rises, driving the marketplace to increase. Technological improvements play a pivotal position in shaping the marketplace dynamics of Drone Sensors. The continuous evolution of sensor technologies, including LiDAR, GPS, thermal imaging, and multispectral sensors, expands the capabilities of drones. These advancements allow drones to perform complicated tasks with precision, growing their applicability and riding the adoption of sensor-geared-up drone answers. As the era continues to develop, the marketplace dynamics are predicted to shift towards more sophisticated and specialized sensor packages. Regulatory elements appreciably affect the marketplace dynamics of the Drone Sensor enterprise. Governments globally are organizing and refining rules to regulate drone usage, making sure protection, safety, and privacy are maintained. Compliance with those regulations is crucial for enterprise members, influencing product improvement and marketplace strategies. Cost concerns are essential to the dynamics of the Drone Sensor marketplace. While technological advancements have made sensor answers extra less expensive, the overall value of imposing Drone Sensor systems remains a critical component. End customers evaluate the fee-effectiveness of these structures, considering elements along with sensor performance, renovation, and usual cost. Market dynamics are, consequently, stimulated through organizations that can strike a balance between imparting awesome Drone Sensors and retaining competitive pricing. Global economic situations also contribute to the market dynamics of Drone Sensors. Economic stability and growth drive investments across industries, including the ones heavily reliant on drone generation. During monetary downturns, however, agencies may also prioritize crucial costs, affecting the adoption of Drone Sensor systems. The integration of synthetic intelligence (AI) and system learning (ML) technology is a transformative dynamic within the Drone Sensor marketplace. These technologies empower Drone Sensors to analyze tremendous amounts of statistics in real-time, allowing self-sufficient choice-making and enhancing average operational performance. As AI and ML integration become more general, the marketplace dynamics are expected to shift in the direction of an extra emphasis on intelligent and autonomous drone structures, influencing product improvement and marketplace trends.

Leave a Comment