Growing Demand for Electric Vehicles

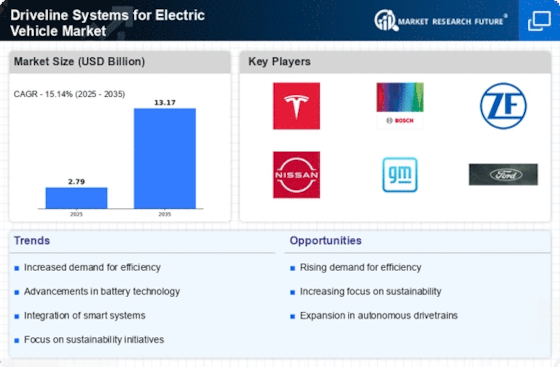

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Driveline Systems for Electric Vehicle Market. As environmental concerns rise, more consumers are opting for EVs over traditional internal combustion engine vehicles. In 2025, it is estimated that the sales of electric vehicles will surpass 10 million units, indicating a robust growth trajectory. This surge in demand necessitates the development of efficient driveline systems that can enhance vehicle performance and range. Consequently, manufacturers are investing in innovative driveline technologies to meet consumer expectations and regulatory standards, thereby propelling the market forward.

Government Incentives and Regulations

Government policies and incentives aimed at promoting electric vehicle adoption are significantly influencing the Driveline Systems for Electric Vehicle Market. Many countries are implementing stringent emissions regulations and offering tax credits, rebates, and subsidies to encourage consumers to purchase EVs. For example, in 2025, several regions are expected to enhance their incentives, making electric vehicles more financially attractive. This regulatory support not only boosts consumer demand but also compels manufacturers to innovate and improve their driveline systems to comply with new standards. As a result, the market is likely to experience accelerated growth due to these favorable policies.

Technological Advancements in Driveline Systems

Technological innovation plays a crucial role in shaping the Driveline Systems for Electric Vehicle Market. The integration of advanced technologies such as electric motors, regenerative braking, and sophisticated control systems is enhancing the efficiency and performance of EV driveline systems. For instance, the adoption of dual-motor systems is becoming more prevalent, allowing for improved torque distribution and acceleration. Furthermore, advancements in battery technology are enabling longer ranges and faster charging times, which are essential for consumer acceptance. As these technologies continue to evolve, they are likely to drive market growth and create new opportunities for manufacturers.

Focus on Sustainability and Environmental Impact

The increasing emphasis on sustainability is driving the Driveline Systems for Electric Vehicle Market. Consumers and manufacturers alike are becoming more aware of the environmental impact of their choices. This awareness is leading to a demand for driveline systems that utilize sustainable materials and manufacturing processes. Companies are exploring the use of recycled materials and eco-friendly production methods to reduce their carbon footprint. In 2025, it is anticipated that a significant portion of new driveline systems will incorporate sustainable practices, aligning with the broader trend of environmental responsibility in the automotive sector. This shift not only meets consumer expectations but also enhances brand reputation.

Rising Investment in Electric Mobility Infrastructure

Investment in electric mobility infrastructure is a critical driver for the Driveline Systems for Electric Vehicle Market. The expansion of charging networks and support facilities is essential for the widespread adoption of electric vehicles. In 2025, it is projected that investments in charging infrastructure will reach unprecedented levels, facilitating easier access to charging stations for consumers. This infrastructure development not only alleviates range anxiety but also encourages manufacturers to enhance their driveline systems to support faster charging capabilities. As the infrastructure improves, it is likely to stimulate further growth in the electric vehicle market, thereby benefiting the driveline systems sector.