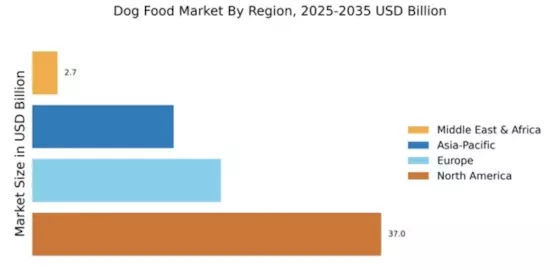

North America : Market Leader in Dog Food

North America continues to lead The Dog Food, holding a significant share of 37.0% in 2024. The growth is driven by increasing pet ownership, a rising trend towards premium and organic pet food, and stringent regulations ensuring product safety and quality. The demand for specialized diets, including grain-free and high-protein options, is also on the rise, reflecting changing consumer preferences and health consciousness among pet owners.

The competitive landscape is robust, with key players such as Nestle Purina PetCare, Mars Petcare, and Hill's Pet Nutrition dominating the market. These companies are continuously innovating to meet consumer demands, introducing new flavors and formulations. The presence of established brands and a strong distribution network further solidify North America's position as the largest market for dog food, catering to diverse consumer needs and preferences.

Europe : Emerging Trends in Pet Nutrition

Europe's dog food market is experiencing significant growth, with a market size of €20.0 billion. The increasing trend towards premium and natural pet food products is a key driver, as consumers become more health-conscious about their pets' diets. Regulatory frameworks in the EU are also evolving, focusing on sustainability and transparency in pet food production, which is influencing consumer choices and driving market growth.

Leading countries in this region include Germany, France, and the UK, where the demand for high-quality dog food is particularly strong. Major players like Royal Canin and other local brands are adapting to these trends by offering specialized products. The competitive landscape is characterized by innovation and a focus on health benefits, with companies investing in research to develop products that cater to specific dietary needs of dogs.

Asia-Pacific : Rapid Growth in Pet Ownership

The Asia-Pacific region is witnessing rapid growth in the dog food market, with a market size of $15.0 billion. This growth is fueled by rising disposable incomes, urbanization, and an increasing trend of pet ownership, particularly in countries like China and India. Consumers are becoming more aware of pet nutrition, leading to a demand for premium and specialized dog food products. Regulatory bodies are also enhancing food safety standards, which is positively impacting market growth.

Countries such as China, Japan, and Australia are leading the market, with a mix of local and international brands competing for market share. Key players like Blue Buffalo and WellPet are expanding their presence in this region, focusing on product innovation and marketing strategies tailored to local preferences. The competitive landscape is dynamic, with companies increasingly investing in e-commerce to reach a broader audience.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is emerging as a potential market for dog food, with a market size of $2.67 billion. The growth is driven by increasing pet ownership and a shift towards premium pet food products. Urbanization and changing lifestyles are contributing to the rising demand for high-quality dog food. Regulatory frameworks are gradually improving, focusing on food safety and quality standards, which is essential for market expansion.

Countries like South Africa and the UAE are leading the market, with a growing number of local and international brands entering the space. The competitive landscape is evolving, with companies focusing on product differentiation and marketing strategies that resonate with local consumers. As awareness of pet nutrition increases, the market is expected to grow, presenting opportunities for both established and new players.