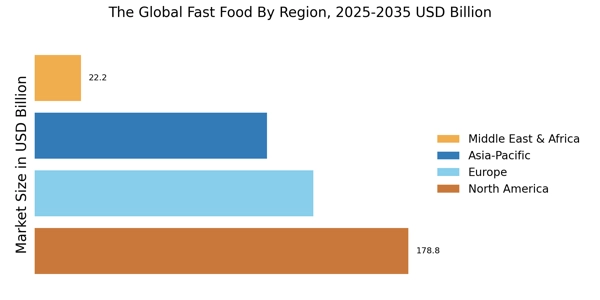

North America : Fast Food Market Capital of the World

North America remains the largest market for fast food, accounting for approximately 40% of the global market share. North America accounts for the largest share of the global fast food market, followed by Europe and Asia-Pacific. Key growth drivers include a high demand for convenience, a growing trend towards online ordering, and a robust delivery infrastructure. Regulatory support for food safety and health standards further catalyzes market growth, ensuring consumer trust and compliance. The U.S. is the largest market, followed by Canada, which holds about 10% of the Fast Food Market share. The Canada fast food market continues to grow steadily, supported by increasing adoption of delivery services and strong brand penetration. The competitive landscape is dominated by major players such as McDonald's, Yum! Brands, and Domino's Pizza, which have established strong brand loyalty and extensive distribution networks. The presence of these key players fosters innovation and adaptation to consumer preferences, such as healthier menu options and sustainable practices. The market is characterized by intense competition, with continuous efforts to enhance customer experience and expand service offerings.

Europe : Emerging Fast Food Market Trends

Europe is witnessing a significant transformation in the fast food sector, holding approximately 30% of the global market share. The region's growth is driven by increasing urbanization, changing consumer lifestyles, and a rising preference for quick-service restaurants. Regulatory frameworks promoting healthier eating habits and sustainability are also influencing market dynamics. The UK and Germany are the largest markets, contributing significantly to the overall growth, with the UK alone accounting for about 15% of the market share. The UK fast food market remains one of the largest in Europe, driven by urban lifestyles and growing demand for quick-service restaurants. The UK contributes a significant share of the European fast food market, reflecting high consumer spending on fast food products. Germany represents a major market within the European fast food industry, supported by strong consumer demand and international brand presence. The France fast food market is evolving rapidly, with increasing acceptance of international fast food chains alongside local brands. Leading countries in Europe are adapting to local tastes, with key players like McDonald's and Subway tailoring their menus to meet regional preferences. The competitive landscape is marked by a mix of global chains and local brands, fostering innovation in product offerings. The presence of diverse culinary influences encourages fast food chains to experiment with flavors and ingredients, enhancing customer engagement and satisfaction.

Asia-Pacific : Rapid Growth and Expansion

Asia-Pacific is rapidly becoming a powerhouse in the fast food market, holding around 25% of the global market share. The region's growth is fueled by a burgeoning middle class, increasing disposable incomes, and a shift towards Western dining habits. Countries like China and India are leading this growth, with China alone accounting for nearly 15% of the Fast Food Market. The China fast food market is experiencing rapid expansion due to rising disposable incomes and changing dining habits. China accounts for a substantial share of the Asia-Pacific fast food market, supported by a large urban population. The fast food market in India is growing at a fast pace, driven by young consumers, urbanization, and expanding food delivery platforms. Thailand contributes a growing share to the regional fast food market, supported by tourism and urban consumption patterns. Australia holds a notable share in the Asia-Pacific fast food market, supported by strong brand presence and high consumer spending. Regulatory initiatives aimed at food safety and quality assurance are also pivotal in shaping consumer trust and market expansion. The competitive landscape is characterized by both international and local players, with McDonald's and KFC being prominent. Local chains are also gaining traction by offering culturally relevant menu items. The presence of key players fosters a dynamic environment where innovation thrives, with many brands focusing on digital transformation and delivery services to cater to the evolving consumer preferences in this diverse region.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is emerging as a significant player in The Global Fast Food Market, holding approximately 5% of the market share. The growth is driven by urbanization, a young population, and increasing consumer spending on dining out. Regulatory frameworks are gradually evolving to support food safety and quality, which is essential for attracting international brands. Countries like South Africa and the UAE are leading the market, with the UAE showing a strong appetite for international fast food brands. The competitive landscape is diverse, with a mix of global chains and local establishments. Key players such as McDonald's and KFC are expanding their footprint, while local brands are innovating to cater to regional tastes. The market is characterized by a growing trend towards delivery services and online ordering, reflecting changing consumer behaviors and preferences in this dynamic region.