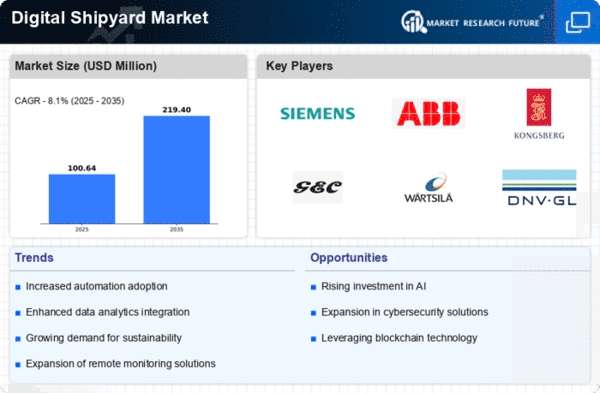

The Digital Shipyard Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and the increasing demand for efficiency in shipbuilding processes. Key players such as Siemens AG (DE), ABB Ltd (CH), and Kongsberg Gruppen (NO) are at the forefront, each adopting distinct strategies to enhance their market positioning. Siemens AG (DE) focuses on digital transformation initiatives, leveraging its expertise in automation and data analytics to optimize shipyard operations. Meanwhile, ABB Ltd (CH) emphasizes sustainability, integrating energy-efficient solutions into its offerings, which aligns with global environmental goals. Kongsberg Gruppen (NO) is notable for its commitment to innovation, particularly in autonomous maritime technologies, which positions it as a leader in the evolving digital landscape.The business tactics employed by these companies reflect a concerted effort to localize manufacturing and optimize supply chains, thereby enhancing operational efficiency. The market structure appears moderately fragmented, with several players vying for dominance. However, the collective influence of these key players is significant, as they drive technological advancements and set industry standards that shape competitive dynamics.

In November Siemens AG (DE) announced a strategic partnership with a leading maritime technology firm to develop advanced digital solutions for shipyards. This collaboration is expected to enhance Siemens' capabilities in providing integrated digital services, thereby reinforcing its competitive edge in the market. The strategic importance of this partnership lies in its potential to accelerate innovation and improve operational efficiencies for shipbuilders.

In October ABB Ltd (CH) launched a new suite of energy management solutions aimed at reducing emissions in shipbuilding. This initiative not only underscores ABB's commitment to sustainability but also positions the company as a frontrunner in the transition towards greener maritime operations. The launch is likely to attract shipbuilders seeking to comply with stringent environmental regulations, thereby expanding ABB's market share.

In September Kongsberg Gruppen (NO) unveiled a groundbreaking autonomous vessel technology that promises to revolutionize ship operations. This development is particularly significant as it aligns with the industry's shift towards automation and digitalization. By leading in this area, Kongsberg is poised to capture a substantial share of the market, appealing to shipbuilders looking to enhance operational efficiency and reduce costs.

As of December the Digital Shipyard Market is witnessing trends that emphasize digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering innovation and collaboration. Looking ahead, it is anticipated that competitive differentiation will evolve, with a shift from price-based competition to a focus on technological innovation, reliability in supply chains, and sustainable practices. This evolution suggests that companies that prioritize these aspects will likely emerge as leaders in the Digital Shipyard Market.