Increasing Demand for LNG

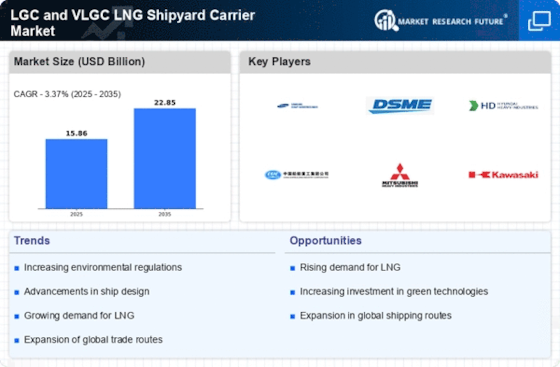

The rising demand for liquefied natural gas (LNG) is a primary driver for the LGC and VLGC LNG Shipyard Carrier Market. As countries seek cleaner energy alternatives, LNG has emerged as a preferred choice due to its lower carbon emissions compared to coal and oil. According to recent data, the demand for LNG is projected to grow at a compound annual growth rate of approximately 5.5% over the next decade. This surge in demand necessitates the construction of more LNG carriers, thereby stimulating the shipyard industry. Furthermore, the shift towards LNG in maritime transport is likely to enhance the need for specialized carriers, which could lead to increased investments in shipbuilding and design innovations within the LGC and VLGC LNG Shipyard Carrier Market.

Expansion of LNG Infrastructure

The expansion of LNG infrastructure is a crucial driver for the LGC and VLGC LNG Shipyard Carrier Market. As more countries invest in LNG terminals and distribution networks, the need for efficient transportation of LNG becomes paramount. This infrastructure development is expected to create a ripple effect, increasing the demand for LNG carriers to facilitate the supply chain. Recent reports indicate that investments in LNG infrastructure are projected to reach several billion dollars over the next few years, further solidifying the market's growth potential. Shipyards are likely to benefit from this trend as they ramp up production to meet the rising demand for new carriers, thereby enhancing their role in the LGC and VLGC LNG Shipyard Carrier Market.

Regulatory Support for Cleaner Fuels

Regulatory frameworks promoting the use of cleaner fuels are significantly influencing the LGC and VLGC LNG Shipyard Carrier Market. Governments worldwide are implementing stricter emissions regulations, which favor LNG as a cleaner alternative to traditional fuels. For instance, the International Maritime Organization has set ambitious targets to reduce greenhouse gas emissions from shipping by at least 50% by 2050. This regulatory environment is likely to drive shipowners to invest in LNG carriers, thus boosting demand for new vessels. The shipyard industry is expected to respond by enhancing their capabilities to build more efficient and compliant LNG carriers, aligning with the evolving regulatory landscape. Consequently, this trend may lead to a more robust market for LGC and VLGC LNG Shipyard Carrier Market.

Growing Investment in Renewable Energy

The growing investment in renewable energy sources is indirectly influencing the LGC and VLGC LNG Shipyard Carrier Market. As nations transition towards sustainable energy solutions, LNG is often viewed as a bridge fuel that supports this shift. Investments in renewable energy projects are leading to increased demand for LNG as a backup energy source, particularly in regions where renewable capacity is still developing. This trend is likely to drive the construction of more LNG carriers to ensure a reliable supply of natural gas. Consequently, shipyards may experience heightened activity as they respond to the evolving energy landscape, positioning themselves to capitalize on the opportunities within the LGC and VLGC LNG Shipyard Carrier Market.

Technological Advancements in Shipbuilding

Technological advancements in shipbuilding are reshaping the LGC and VLGC LNG Shipyard Carrier Market. Innovations such as digital twin technology, automation, and advanced materials are enhancing the efficiency and safety of LNG carriers. These technologies not only reduce construction time but also improve the operational performance of vessels. For example, the integration of smart technologies allows for real-time monitoring of ship systems, which can lead to significant cost savings in maintenance and operation. As shipyards adopt these advanced technologies, they are likely to attract more orders for LNG carriers, thereby driving growth in the LGC and VLGC LNG Shipyard Carrier Market. The ongoing evolution in shipbuilding practices suggests a promising future for the industry.