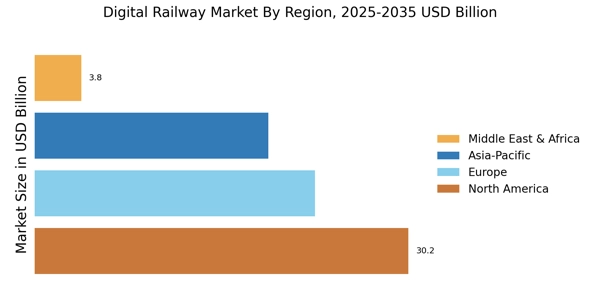

North America : Digital Innovation Leader

North America is poised to dominate the digital railway market, driven by significant investments in infrastructure and technology. The region is expected to hold approximately 40% of the global market share by 2025, with the U.S. leading the charge. Regulatory support, such as the Federal Railroad Administration's initiatives, is catalyzing growth, enhancing safety, and improving operational efficiency. Demand for smart rail solutions is surging, fueled by urbanization and the need for sustainable transport solutions. The competitive landscape in North America features key players like GE Transportation and Cisco Systems, who are at the forefront of digital transformation in railways. The U.S. is the largest market, followed by Canada, which is also investing heavily in modernizing its rail infrastructure. Companies are focusing on IoT, AI, and data analytics to enhance operational efficiency and customer experience, making the region a hotbed for innovation in the digital railway sector.

Europe : Regulatory Framework Support

Europe is experiencing a significant transformation in its railway sector, with a projected market share of around 30% by 2025. The European Union's commitment to sustainable transport and digitalization is a key driver, supported by regulations such as the Fourth Railway Package, which aims to enhance interoperability and safety across member states. This regulatory framework is fostering innovation and investment in digital railway technologies, making Europe a leader in this space. Leading countries in this market include Germany, France, and the UK, where major players like Siemens and Alstom are actively developing advanced digital solutions. The competitive landscape is characterized by collaborations between technology firms and railway operators, focusing on smart signaling, predictive maintenance, and enhanced passenger services. This synergy is crucial for meeting the growing demand for efficient and sustainable rail transport solutions across the continent.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging as a significant player in the digital railway market, expected to capture around 25% of the global share by 2025. Countries like China and India are leading this growth, driven by urbanization, population growth, and government initiatives to modernize rail infrastructure. Investments in smart technologies and digital solutions are being prioritized to improve efficiency and safety in rail operations, supported by favorable government policies and funding. China is the largest market in the region, with substantial investments in high-speed rail and smart railway systems. India follows closely, focusing on upgrading its existing railway network with digital technologies. Key players such as Hitachi and ABB are actively involved in this transformation, providing innovative solutions that enhance operational efficiency and passenger experience, making the Asia-Pacific region a focal point for digital railway advancements.

Middle East and Africa : Infrastructure Development Focus

The Middle East and Africa region is gradually developing its digital railway market, projected to hold about 5% of the global share by 2025. The growth is primarily driven by infrastructure development initiatives in countries like the UAE and South Africa, where governments are investing in modernizing rail systems to enhance connectivity and efficiency. Regulatory support and international partnerships are also playing a crucial role in facilitating this transformation, making the region an emerging market for digital railway solutions. In the UAE, significant investments in rail infrastructure, such as the Etihad Rail project, are paving the way for digital advancements. South Africa is also focusing on upgrading its rail network with smart technologies. Key players like Thales and Nokia are actively participating in these developments, providing innovative solutions that cater to the unique challenges of the region, thus positioning the Middle East and Africa as a growing market for digital railway technologies.