Top Industry Leaders in the Digital Identity in BFSI Market

Competitive Landscape of Digital Identity in BFSI Market: A Comprehensive Analysis

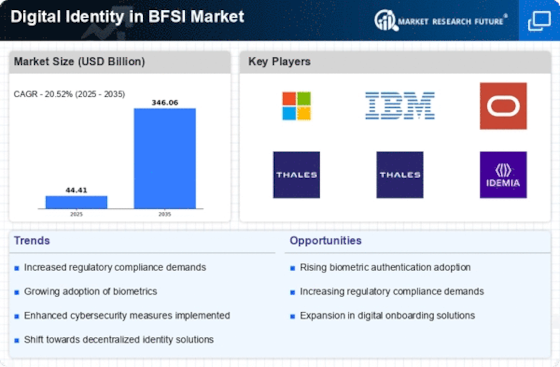

The Banking, Financial Services, and Insurance (BFSI) sector is undergoing a digital revolution, with digital identity solutions taking center stage. This rapidly evolving landscape is teeming with established players, nimble startups, and diverse approaches, all vying for a share in the burgeoning market. Understanding the competitive dynamics is crucial for both established BFSI players and potential entrants seeking to navigate this dynamic space.

Key Players:

-

NEC

-

Samsung SDS

-

Thales

-

Telus

-

IDEMIA

-

GBG

-

Tessi

-

Daon

-

ForgeRock

-

ImageWare

-

Jumio

-

iProov

-

ID R&D

-

Refinitiv

-

OneSpan

-

Smartmatic

-

Freja EID Group

-

Vintegris

-

AU10TIX

-

Signicat

-

Duo Security

-

Syntizen

-

Hashcash Consultant

-

Good Digital Identity

Strategies Adopted:

-

Partnership Ecosystem Building: Established players are forging partnerships with niche startups and technology providers to offer comprehensive, end-to-end digital identity solutions. This collaborative approach allows them to leverage expertise and cater to diverse customer needs.

-

Open Banking and Interoperability: Players are embracing open-banking APIs and interoperable identity frameworks to enable secure data sharing and seamless customer experiences across different financial institutions. This fosters competition and innovation within the ecosystem.

-

Focus on User Experience: Simplifying onboarding processes, integrating biometric authentication, and offering intuitive interfaces are key strategies to enhance user experience and adoption of digital identity solutions.

-

Compliance and Security: Adherence to stringent data privacy regulations like GDPR and PSD2 is paramount. Players are investing heavily in robust security infrastructure and data encryption technologies to ensure customer trust and regulatory compliance.

Factors for Market Share Analysis:

-

Technology Breadth and Depth: The range of functionalities offered, from basic authentication to advanced fraud prevention, plays a crucial role in attracting customers.

-

Customer Focus and User Experience: Ease of use, integration with existing systems, and seamless onboarding processes are critical differentiators.

-

Regulatory Compliance and Security: Robust security measures and adherence to data privacy regulations are essential for building trust and brand reputation.

-

Partnerships and Ecosystem Building: Collaboration with established players, fintech startups, and technology providers can expand reach and offer comprehensive solutions.

-

Pricing and Cost-Effectiveness: Competitive pricing models and flexible deployment options are vital for attracting different customer segments.

New and Emerging Companies:

Several startups are disrupting the market with innovative solutions:

-

Socure: Utilizes machine learning to analyze social media data for identity verification, offering a unique approach to fraud prevention.

-

IDEX: Develops decentralized identity solutions that empower individuals to control their own data, potentially transforming the traditional identity model.

-

Unum ID: Offers a biometric authentication platform that leverages behavioral analysis for enhanced security and user convenience.

Current Investment Trends:

-

Focus on Biometric Authentication: Facial recognition, fingerprint scanners, and voice recognition are gaining traction for their secure and user-friendly nature.

-

Blockchain Adoption: While still in its early stages, blockchain-based identity solutions offer immense potential for secure and decentralized data management.

-

Open Banking and Interoperability: Investments are increasing in developing open-banking APIs and interoperable identity frameworks to facilitate seamless data sharing and customer experiences across financial institutions.

-

Risk Management and Fraud Prevention: AI-powered fraud detection and prevention solutions are in high demand as cyber threats continue to evolve.

Latest Company Updates:

-

Jan 18, 2024: Mastercard partners with Jumio for biometric identity verification for faster and more secure online payments.

-

Jan 12, 2024: IDEMIA launches a new digital identity platform for secure and trusted online transactions.

-

Dec 15, 2023: The United States launches a pilot program for a nationwide digital identity system.