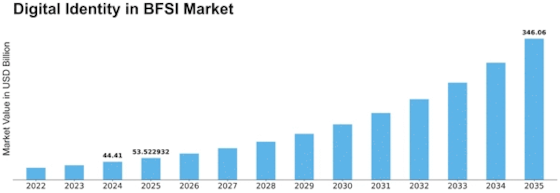

Digital Identity In Bfsi Size

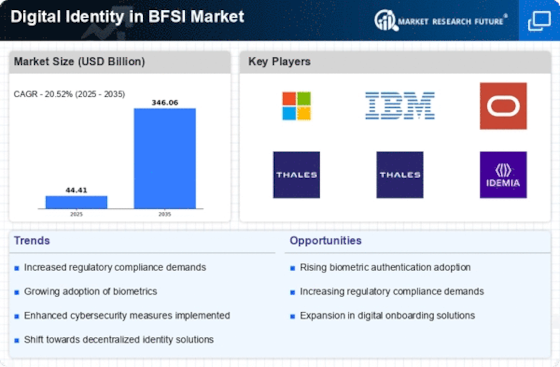

Digital Identity in BFSI Market Growth Projections and Opportunities

The market dynamics of digital identity in the Banking, Financial Services, and Insurance (BFSI) sector are now in the middle of great changes caused by the technological progress, reginal requirements and the changes of customer’s expectations. The BFSI industry has been transforming into digital ones in current years just to secure the most advanced identity solutions for themselves, which helps make processes more efficient and improve customer experience

The regulatory compliance and data security requirements that are becoming ever-more-stringent are other important factors likely to have significant influence on the market patterns. Impacted by the laws like GDPR, PSD2 and KYC the financial institutions are thus driven to invest in the powerful and dependable means of digital identity to help them be compliant and shield their financial data. The result of this flood of online activity is a dramatic push in advance auth, biometric recognition and identity verification technics to protect the users from different risks and fraud.

In addition, the desire for convenient and reliable digital banking consumes from robust identity verification procedures have resulted in an escalation in the need for frictionless identity verification processes. This out render BFSI players to adopt into biometrics, artificial intelligence, and blockchain as the technologies are evolving fast. This enable swift and secure customer onboarding, account access, and transaction authorization. This gradual change to the landscape of identity solutions for convenience but with security is, therefore, bringing about a competitiveness that calls for organizations to be clear and transparent by way of security of login, proper authentication, or somehow following the privacy-friendly path.

In addition, banking being open and digital channels spread progressively has made the digital identity management an even more essential and urgent topic. With the progressive convergence of community and service boundaries by third-party agencies, there is an emergence of a central ground for identification. The technology has, in turn, lit the fuse for federated identity management systems, decentralized identity solutions, and digital wallets that render frictionless identity portability and interoperability across the multitude of financial services and ecosystems.

Further in the scope, the COVID-19 pandemic has sped up digital transformations in the BFSI sector, and therefore the demand for secure, contactless, and remote identity solutions has gained significantly. Many online transactions, new-customer accounts opening, and other digital customer meetings have evidenced the necessity to create robust and flexible digital identity infrastructures that will be able to withstand all adverse conditions. Consequently, BFSI sectors are adapting AI fueled-fraud detection, behavioral biometrics, and continuous authentication techniques which serve as the safeguard of their digital identity from these emerging threats.

Leave a Comment