Market Trends

Key Emerging Trends in the Digital Identity in BFSI Market

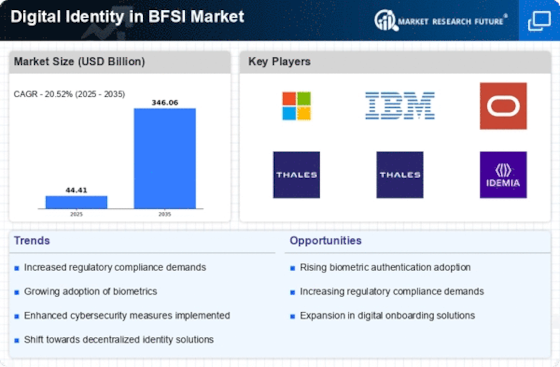

BFSI (Banking, Financial Services, and Insurance) means many things more than what it used to be in those days, this digital identity is a one of the factors that has become more significant. While security and privacy are rapidly rising on the agenda, Digital identity solutions have proved to be the key piece of the BFSI game. While the market share positioning strategies in digital identity of the BFSI sector involve diverse measures, several generalized approaches, however, can be taken into account.

At the same time, brand differentiation is very crucial for successful market positioning of a product. For the enterprises in the BFSI sector, to stay relevant, one of the key demands will be to differentiate their products and services from the competition. This may be done creating specific features which are, for example, biometric or Multi-factor authentication or blockchain-based Identity verification. Through particularly specialized products or services, firms have a chance to be the star of the show in the competitive market scene.

Finally, cusmer oriented solutions of CC need to be emphasized in CCS. Experienced clients now chose BFSI organizations more intensively than before, and customer service is the key in this regard. Digital identity solutions form no exception. Prudent positioning strategies should include user-interface design that is both intuitive and streamlined, smooth interoperability with established banking systems, as well as the provision of a secure and private data storage and handling architecture. This strategy allows such companies to get a competitive advantage and increase their market share as they are aligned with the needs and tastes of their clients.

Also partnerships and coöperation with other bêta companies determines the market positioning. Qualified information professionals can develop partnerships with the leading banks, insurance firms, or financial services companies. Through combining their solutions with available IT platforms of such establishments, digital identity providers can be therefore, have a less strained access to a broader market as well as higher visibility in the market which is critical. Also, partnerships with technology business companies that have developed from cybersecurity firms can give additional credibility and robustness to the digital identity products, therefore, they might have strong positions in the market as well.

Moreover, a strategy to marketing and sales that touches the market and customers directly is require. Digital identity providers ought to precisely govern such segments of the BFSI market in which their products can evidence the ultimate value to customers. This is just one example of the vast array of financial services that can be targeted, from small and medium-sized banks, to insurance companies handling high value transactions, to technology startups. Thus, a tailored marketing and sales plan can help in a successful conquest of the market share time and again.

Leave a Comment