Leading market players are investing heavily in the research and development in order to expand their product lines, which will help the Diffusion Equipment Market grow even more. Market players are also undertaking a variety of strategic activities to spread their global footprint, with important market developments including mergers and acquisitions, new product launches, contractual agreements, higher investments, and collaboration with other organizations. To spread and survive in a more competitive and rising market climate, the Diffusion Equipment industry must offer cost-effective items.

Manufacturing locally to minimize the operational costs is one of the key business tactics used by the manufacturers in the global Diffusion Equipment industry to benefit the clients and increase the market sector. In recent years, the diffusion equipment industry has offered some of the most significant advantages to several other industries.

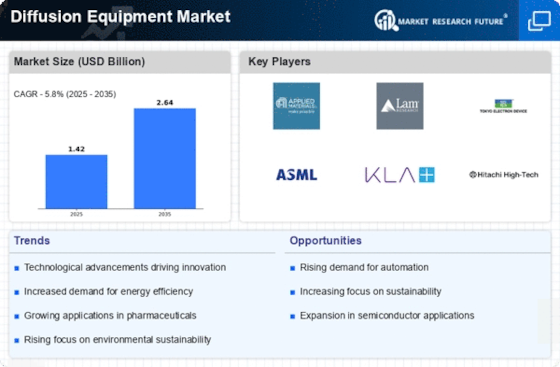

Major players in the Diffusion Equipment Market, including Applied Materials, Inc., ASML Holding NV, Lam Research Corporation, Tokyo Electron Limited, KLA Corporation, SCREEN Semiconductor Solutions Co., Ltd., ASM International NV, Hitachi High-Tech Corporation, Ulvac Inc., Nikon Corporation, and others, are trying to increase market demand by investing in the research and development operations.

KLA Corporation is a prominent American company specializing in process control solutions for the semiconductor and related industries. Headquartered in Milpitas, California, KLA is a leading provider of inspection, metrology, and process control systems designed to enhance the efficiency and yield of semiconductor manufacturing processes. With a history dating back to 1976, KLA has played a important role in advancing technology by delivering innovative solutions for monitoring and optimizing the fabrication of semiconductors.

The company's comprehensive product portfolio includes tools for wafer inspection, reticle inspection, and metrology, contributing to the production of high-performance and the reliable semiconductor devices across various applications.

In July KLA Corporation acquired Orbotech, a provider of inspection and metrology equipment for the semiconductor and printed circuit board industries, for $3.4 billion. This acquisition will give KLA a broader portfolio of inspection and metrology equipment, which are used to ensure the quality of chips and other electronic components.

LAM Research Corporation is a prominent American multinational corporation specializing in the design and the manufacturing of semiconductor equipment. Established in 1980 and headquartered in Fremont, California, LAM Research has become a leading supplier of wafer fabrication equipment and the services for global semiconductor industry. The company's product portfolio includes a comprehensive range of solutions, such as deposition, etching, and cleaning systems that are integral to the semiconductor manufacturing process. LAM Research has played a crucial role in advancing semiconductor technology, contributing to the development of smaller, more powerful, and energy-efficient electronic devices.

In August 2023, Lam Research acquired Versum Materials, a supplier of chemical vapor deposition (CVD) and advanced etch equipment, for $6.5 billion. This acquisition will give Lam Research a broader portfolio of CVD and etch equipment, which are used in a variety of chip manufacturing processes.