Top Industry Leaders in the Diffusion Equipment Market

The Competitive Landscape of the Diffusion Equipment Market

In the intricate symphony of modern manufacturing, where molecules dance to precise choreography, diffusion equipment acts as the unseen conductor, orchestrating their movement and facilitating intricate chemical reactions. This dynamic market hums with innovation, fierce competition, and the promise of powering diverse applications across industries. Navigating this complex space requires discerning the strategies of key players, understanding market share nuances, and recognizing the emerging trends shaping its future rhythm.

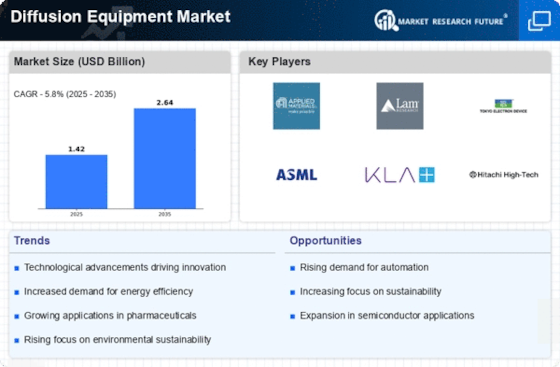

Key Players:

- Applied Materials, Inc.

- ASML Holding NV

- Lam Research Corporation

- Tokyo Electron Limited

- KLA Corporation

- SCREEN Semiconductor Solutions Co., Ltd.

- ASM International NV

- Hitachi High-Tech Corporation

- Ulvac Inc.

- Nikon Corporation

Strategies Adopted by Leaders:

- Technological Prowess: Sartorius Stedim Lab Technologies and Danfoss A/S lead the charge with expertise in high-performance ceramic membranes, advanced control systems, and integrated process modules, catering to demanding pharmaceutical and bioprocessing applications.

- Vertical Specialization: GEA Group focuses on cost-effective and reliable membrane systems for wastewater treatment and water desalination, while Koch Membrane Systems targets ruggedized designs for harsh industrial environments like chemical processing.

- Partnership Play: Alfa Laval collaborates with engineering firms and chemical manufacturers, offering end-to-end diffusion solutions and streamlined integration support for customers.

- Open-Source Initiatives and Knowledge Sharing: The European Membrane Society (EMS) promotes standardized test procedures and best practices in membrane technology, benefiting the entire industry.

- Focus on Sustainability and Energy Efficiency: Utilizing high-flux membranes, optimizing process parameters, and minimizing energy consumption builds trust and caters to growing environmental concerns.

Factors for Market Share Analysis:

- Performance and Separation Efficiency: Companies offering systems with high flux rates, superior selectivity, and durable membranes command premium prices and secure market share by optimizing production throughput and product purity.

- Modular Design and Scalability: Providing flexible and scalable systems adaptable to diverse production capacities and changing process requirements attracts a wider customer base and facilitates future expansions.

- Ease of Operation and Maintenance: Offering user-friendly interfaces, automated cleaning functionalities, and readily available technical support simplifies operation and minimizes downtime.

- Cost Competitiveness and Affordability: Balancing advanced features with an attractive price point is crucial for capturing market share, particularly in price-sensitive applications and emerging markets.

- Focus on Sustainability and Green Design: Utilizing recycled materials, minimizing waste generation, and offering energy-efficient systems caters to growing environmental concerns and opens doors to eco-conscious buyers.

New and Emerging Companies:

- Startups like Graphex Technologies and Porifera: These innovators focus on developing next-generation membranes based on graphene and other advanced materials, aiming for ultra-high separation efficiency, improved chemical resistance, and longer lifespans.

- Academia and Research Labs: MIT's Department of Chemical Engineering and Stanford University's Department of Materials Science & Engineering explore next-generation technologies like biomimetic membranes, integrated sensors, and advanced membrane materials, shaping the future of the market.

- Advanced Material Science Innovations: Companies like 3M and Dow Chemical develop high-performance polymers and ceramics with improved membrane selectivity, fouling resistance, and thermal stability, enabling the development of more efficient and durable systems.

Industry Developments:

Applied Materials, Inc.:

- October 26, 2023: Announced the launch of its latest Centura diffusion furnace with improved uniformity and scalability for advanced logic and memory production.

- September 2023: Partnered with a leading Taiwanese foundry to develop next-generation diffusion processes for 3D NAND technology.

ASML Holding NV:

- October 25, 2023: Unveiled its roadmap for beyond-EUV lithography solutions, potentially impacting future diffusion equipment requirements.

- August 2023: Collaborated with a research institute to develop novel materials for diffusion chambers with enhanced thermal performance.

Lam Research Corporation:

- October 24, 2023: Introduced a new low-temperature diffusion system for improved device performance and energy efficiency.

- July 2023: Partnered with a major Chinese fab to supply diffusion equipment for their cutting-edge memory fab.