Growth in Food and Beverage Sector

The diaphragm pumps market is benefiting from the growth in the food and beverage sector, where hygiene and precision are paramount. Diaphragm pumps are increasingly utilized for transferring various food products, including liquids and semi-solids, due to their ability to maintain product integrity and prevent contamination. The food and beverage industry is projected to expand significantly, driven by changing consumer preferences and the demand for processed foods. This growth is likely to enhance the diaphragm pumps market, as manufacturers seek reliable and efficient pumping solutions that comply with stringent food safety regulations. Consequently, the diaphragm pumps market is poised for substantial growth in this sector.

Rising Demand in Chemical Processing

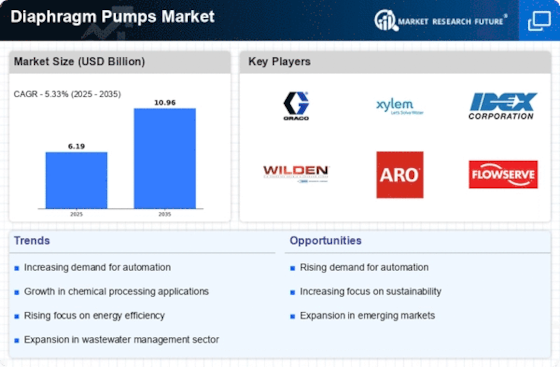

The diaphragm pumps market is experiencing a notable increase in demand, particularly within the chemical processing sector. This growth is attributed to the pumps' ability to handle corrosive and viscous fluids, which are prevalent in chemical manufacturing. As industries seek to enhance operational efficiency, diaphragm pumps are favored for their reliability and low maintenance requirements. According to recent data, the chemical processing segment is projected to account for a substantial share of the diaphragm pumps market, driven by the need for safe and efficient fluid transfer. Furthermore, the increasing complexity of chemical formulations necessitates advanced pumping solutions, thereby propelling the diaphragm pumps market forward.

Technological Innovations in Pump Design

The diaphragm pumps market is witnessing a wave of technological innovations that enhance pump performance and efficiency. Advances in materials and design have led to the development of more durable and efficient diaphragm pumps, which are capable of operating under extreme conditions. These innovations not only improve the lifespan of the pumps but also reduce energy consumption, making them more cost-effective for end-users. As industries increasingly prioritize efficiency and sustainability, the demand for technologically advanced diaphragm pumps is expected to rise. This trend indicates a promising future for the diaphragm pumps market, as manufacturers continue to invest in research and development to meet evolving market needs.

Expansion in Water and Wastewater Management

The diaphragm pumps market is significantly influenced by the expansion of water and wastewater management initiatives. As urbanization accelerates, the demand for effective water treatment solutions rises, leading to increased adoption of diaphragm pumps. These pumps are particularly effective in handling sludges and other challenging materials found in wastewater. Recent statistics indicate that the water and wastewater management sector is expected to witness a robust growth rate, contributing to the overall expansion of the diaphragm pumps market. This trend is further supported by governmental investments in infrastructure, aimed at improving water quality and accessibility, which in turn bolsters the diaphragm pumps market.

Increased Focus on Environmental Regulations

The diaphragm pumps market is significantly impacted by the increasing focus on environmental regulations across various sectors. Stricter regulations regarding emissions and waste management are driving industries to adopt more efficient and environmentally friendly pumping solutions. Diaphragm pumps, known for their ability to minimize leaks and spills, are becoming a preferred choice for companies aiming to comply with these regulations. The market data suggests that as environmental standards become more stringent, the diaphragm pumps market is likely to experience growth, as businesses seek to enhance their sustainability practices. This shift not only benefits the environment but also positions diaphragm pumps as a critical component in achieving compliance.