Top Industry Leaders in the Diaphragm Pumps Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

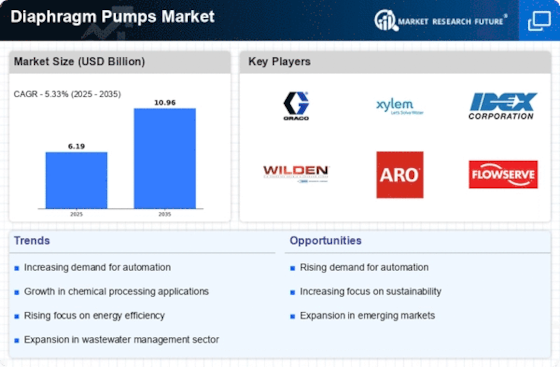

Competitive Landscape of Diaphragm Pumps Market: An In-Depth Analysis

The global diaphragm pump market, presents a captivating battleground for leading players. Understanding the strategies, trends, and market share dynamics is crucial for navigating this dynamic landscape.

Key Players and Their Strategies:

Global Giants: Leading companies like Sandvik, Wilfried Leuze GmbH, Yamada Corporation, and Graco Inc. leverage their extensive networks, established brands, and R&D prowess to maintain market dominance. They focus on expanding product portfolios, particularly in high-growth segments like electric-powered and high-pressure models. Strategic acquisitions to bolster offerings and geographical reach are also commonplace.

Regional Contenders: Companies like Wancheng Hydraulic Machinery Co., Ltd. and IWAKI Co., Ltd. are carving strong niches in their respective regions. They prioritize cost-effective production, customization options, and tailoring solutions to specific end-user needs. Building robust distribution networks and fostering close relationships with regional players in key industries like water treatment and chemical processing contribute to their success.

Innovators and Niche Players: Startups and smaller players are injecting dynamism into the market by focusing on disruptive technologies and specialized applications. Development of energy-efficient pumps, smart pumps with integrated sensors, and pumps compatible with highly corrosive or abrasive fluids are some key areas of innovation. They leverage partnerships with established players and targeted marketing to gain traction.

Factors for Market Share Analysis:

Product Portfolio: Diversity in pump types (single vs. double diaphragm, air vs. electric), material options, pressure and flow capacity caters to diverse industry demands. Companies with comprehensive portfolios tailored to specific end-user segments hold an edge.

Geographical Reach: A strong global presence and efficient distribution networks are crucial for reaching a wider customer base. Regional players with established footholds in their respective markets pose substantial competition.

Pricing and Brand Reputation: Cost-competitiveness remains a key consideration, particularly in price-sensitive segments. However, established brands with a reputation for quality and reliability command premium pricing.

Technological Advancements: Investment in R&D to develop energy-efficient, environmentally friendly, and smart pumps is imperative for staying ahead of the curve. Early adopters of new technologies gain a significant advantage.

Customer Service and After-Sales Support: Prompt and efficient customer service, including readily available spare parts and maintenance support, fosters brand loyalty and repeat business.

New and Emerging Trends:

Shift towards Electric Motors: Growing environmental concerns and energy efficiency regulations are driving the shift from air-operated to electric-powered diaphragm pumps. Players offering energy-efficient electric models with comparable performance will gain traction.

Focus on Smart Pumps: Integration of intelligent features like flow monitoring, leak detection, and predictive maintenance capabilities is gaining traction. This caters to the growing demand for process optimization and data-driven decision-making in industries like chemical processing and water treatment.

Customization and Niche Applications: Demand for bespoke diaphragm pumps for specialized applications in industries like pharmaceutical manufacturing and biotechnology is on the rise. Companies with strong customization capabilities and expertise in handling sensitive materials will benefit.

Sustainability Initiatives: Eco-friendly materials, reduced energy consumption, and responsible waste management practices are becoming increasingly important. Players showcasing strong sustainability credentials will attract environmentally conscious customers.

Overall Competitive Scenario:

The diaphragm pump market is characterized by intense competition across all segments. While established players hold a significant share, regional players and innovators are constantly creating disruption with cost-effective solutions and niche offerings. Technological advancements like smart pumps and the shift towards electric motors are reshaping the landscape. Companies that adapt to these trends, invest in R&D, and prioritize customer needs will be best positioned to capitalize on the market's future growth potential.

This analysis provides a comprehensive overview of the competitive landscape in the diaphragm pump market. By understanding the key players, their strategies, market share dynamics, and emerging trends, businesses can make informed decisions and navigate this dynamic market effectively.

IDEX Corporation: Acquired Wilden Pump & Motor in July 2023, expanding its diaphragm pump portfolio for industrial and environmental applications (Source: IDEX Corporation press release, July 18, 2023).

Yamada Corporation: Launched the A-10V series of air-operated diaphragm pumps with improved flow rates and energy efficiency (Source: Yamada Corporation website, accessed January 3, 2024).

Flowserve Corporation: Partnered with Grundfos to develop and manufacture next-generation diaphragm pumps for the chemical processing industry (Source: Flowserve Corporation press release, October 26, 2023).

Ingersoll Rand: Introduced the Micro-Air 2 series of miniature diaphragm pumps for medical and biotechnology applications (Source: Ingersoll Rand website, accessed January 3, 2024).

Top listed global companies in the industry are:

IDEX Corporation (US)

Yamada Corporation (Japan)

Flowserve Corporation (US)

Ingersoll Rand (Ireland)

Grundfos Holding A/S (Denmark)

Xylem Inc. (US)

SPX Flow (US)

Pump Solutions Group (US)

LEWA GmbH (Germany)

Verder International B.V. (The Netherlands)

TAPFLO AB (Sweden)

Leak-Proof Pumps (1) Pvt. Ltd. (India)

All-Flo Pump Co. (US)