Rising Healthcare Expenditure

The upward trend in healthcare expenditure is a crucial factor propelling the Dermatophytic Onychomycosis Treatment Market. As healthcare systems evolve and improve, there is a corresponding increase in spending on dermatological treatments. This rise in expenditure allows for better access to advanced treatment options, including prescription medications and specialized therapies. Furthermore, as patients become more willing to invest in their health, the demand for effective treatments for dermatophytic onychomycosis is likely to grow. Market data indicates that countries with higher healthcare spending tend to report better treatment outcomes, which may further encourage investment in the Dermatophytic Onychomycosis Treatment Market.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is influencing the Dermatophytic Onychomycosis Treatment Market. As awareness of fungal infections increases, individuals are more inclined to seek preventive measures to avoid onychomycosis. This trend is reflected in the rising sales of antifungal products aimed at prevention, such as foot powders and antifungal sprays. Additionally, educational campaigns by healthcare organizations are promoting foot hygiene and early intervention, which may lead to a decrease in the incidence of dermatophytic onychomycosis. Consequently, the focus on prevention is likely to drive demand for both treatment and preventive products within the Dermatophytic Onychomycosis Treatment Market.

Growing Demand for Over-the-Counter Treatments

The increasing consumer preference for over-the-counter (OTC) treatments is shaping the Dermatophytic Onychomycosis Treatment Market. Patients are increasingly seeking accessible and convenient treatment options that do not require a prescription. This trend is driven by the desire for self-management of mild to moderate cases of dermatophytic onychomycosis. Market analysis indicates that the OTC segment is experiencing substantial growth, as consumers are more informed about their treatment choices. The availability of various antifungal creams, sprays, and nail solutions in pharmacies and online platforms is likely to enhance market penetration. As a result, the Dermatophytic Onychomycosis Treatment Market is expected to witness a shift towards more consumer-driven purchasing behaviors.

Technological Advancements in Treatment Options

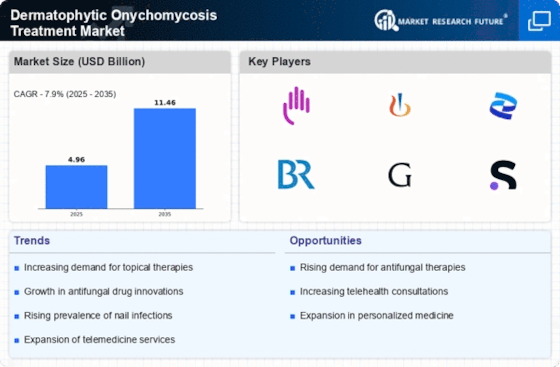

Technological innovations in the development of antifungal agents are significantly influencing the Dermatophytic Onychomycosis Treatment Market. Recent advancements have led to the introduction of novel oral and topical antifungal medications that demonstrate enhanced efficacy and reduced side effects. For instance, the emergence of new drug formulations and delivery systems, such as nail lacquers and systemic therapies, has improved treatment outcomes. Market data suggests that the introduction of these advanced therapies is expected to increase the overall market size, as patients are more likely to adhere to treatment regimens that offer better results. Additionally, ongoing research into combination therapies may further enhance treatment effectiveness, thereby expanding the Dermatophytic Onychomycosis Treatment Market.

Increasing Prevalence of Dermatophytic Onychomycosis

The rising incidence of dermatophytic onychomycosis is a pivotal driver for the Dermatophytic Onychomycosis Treatment Market. Studies indicate that approximately 10% of the population may be affected by this fungal infection, with higher rates observed in older adults. This growing prevalence necessitates effective treatment options, thereby propelling market growth. The increasing number of patients seeking medical attention for nail infections is likely to stimulate demand for antifungal therapies. Furthermore, the aging population, which is more susceptible to such infections, contributes to the expanding patient pool. As awareness of the condition increases, healthcare providers are more frequently diagnosing dermatophytic onychomycosis, further driving the need for innovative treatment solutions within the Dermatophytic Onychomycosis Treatment Market.