Market Growth Projections

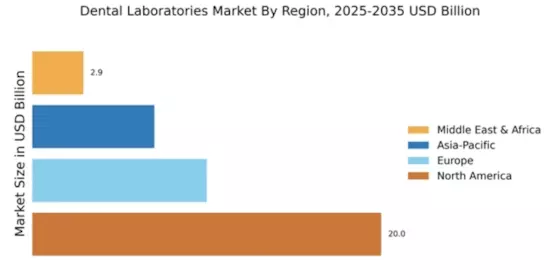

The Global Dental Laboratories Market Industry is projected to experience substantial growth over the next decade. With a market valuation of 16.2 USD Billion in 2024, it is anticipated to reach 25.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 4.17% from 2025 to 2035. The increasing demand for dental services, coupled with advancements in technology and a growing focus on aesthetic solutions, positions the industry for sustained expansion. These projections highlight the potential for dental laboratories to innovate and adapt to changing market dynamics, ensuring their relevance in the evolving landscape.

Growing Awareness of Oral Health

The Global Dental Laboratories Market Industry is positively impacted by the growing awareness of oral health among the general population. Educational initiatives and public health campaigns have heightened understanding of the importance of dental care, leading to increased visits to dental professionals. As individuals prioritize their oral health, the demand for dental services, including those provided by laboratories, rises. This heightened awareness is likely to drive market growth, as more patients seek preventive and restorative treatments. The correlation between oral health awareness and the utilization of dental laboratory services indicates a favorable trend for the industry.

Rising Demand for Dental Prosthetics

The Global Dental Laboratories Market Industry experiences a notable increase in demand for dental prosthetics, driven by an aging population and a growing awareness of oral health. As individuals age, the need for dentures, crowns, and bridges escalates, contributing to market growth. In 2024, the market is valued at approximately 16.2 USD Billion, reflecting the increasing reliance on dental laboratories for high-quality prosthetic solutions. This trend is expected to continue, with projections indicating a market value of 25.4 USD Billion by 2035. The anticipated compound annual growth rate (CAGR) of 4.17% from 2025 to 2035 underscores the sustained demand for dental prosthetics in the global landscape.

Expansion of Dental Insurance Coverage

The expansion of dental insurance coverage significantly influences the Global Dental Laboratories Market Industry. As more individuals gain access to dental insurance, the affordability of dental procedures increases, leading to higher utilization of dental services. This trend is particularly evident in regions where insurance coverage is becoming more comprehensive, allowing patients to seek necessary treatments without financial constraints. Consequently, dental laboratories benefit from this increased patient flow, as more individuals opt for restorative and cosmetic procedures. The positive correlation between insurance coverage and market growth suggests a promising outlook for the dental laboratory sector.

Increased Focus on Aesthetic Dentistry

The Global Dental Laboratories Market Industry is witnessing a shift towards aesthetic dentistry, driven by consumer preferences for cosmetic enhancements. Patients are increasingly seeking solutions that not only restore function but also enhance the appearance of their smiles. This trend is reflected in the rising demand for veneers, whitening treatments, and orthodontic solutions. As dental laboratories adapt to these changing consumer preferences, they are likely to expand their offerings to include more aesthetic options. The growing emphasis on aesthetics in dentistry is expected to contribute to the overall growth of the market, as more individuals prioritize their dental appearance.

Technological Advancements in Dental Lab Equipment

Technological innovations play a pivotal role in shaping the Global Dental Laboratories Market Industry. The integration of advanced digital technologies, such as CAD/CAM systems and 3D printing, enhances the efficiency and accuracy of dental restorations. These advancements not only streamline production processes but also improve the quality of dental products. As laboratories adopt these technologies, they can meet the increasing expectations of dental professionals and patients alike. The ongoing evolution of dental lab equipment is likely to drive market growth, as it enables laboratories to offer more precise and customized solutions, thereby attracting a broader clientele.