Expansion of Telehealth Services

The expansion of telehealth services is reshaping the clinical reference-laboratories market by facilitating remote access to diagnostic testing. As telehealth becomes more prevalent, patients are increasingly able to consult healthcare providers from the comfort of their homes, leading to a rise in laboratory test orders. This trend is particularly relevant in rural and underserved areas where access to healthcare facilities may be limited. The convenience of telehealth is likely to drive higher utilization of laboratory services, thereby enhancing the overall growth of the clinical reference-laboratories market. As telehealth continues to evolve, it may create new avenues for collaboration between healthcare providers and laboratories.

Integration of Advanced Technologies

The integration of advanced technologies into the clinical reference-laboratories market is transforming the landscape of laboratory testing. Innovations such as automation, artificial intelligence (AI), and machine learning are enhancing the efficiency and accuracy of laboratory processes. For instance, automated systems can significantly reduce turnaround times for test results, which is critical in clinical decision-making. Furthermore, AI algorithms are being employed to analyze complex data sets, leading to improved diagnostic accuracy. As a result, laboratories that adopt these technologies may gain a competitive edge, potentially increasing their market share in a rapidly evolving industry.

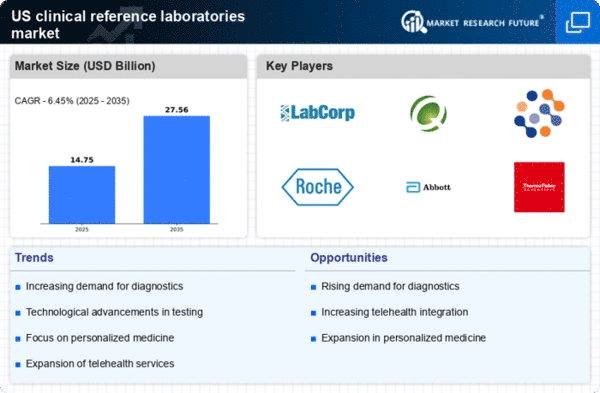

Rising Demand for Diagnostic Testing

The clinical reference-laboratories market is experiencing a notable increase in demand for diagnostic testing services. This surge is driven by a growing awareness of preventive healthcare and the need for early disease detection. As individuals become more health-conscious, the utilization of laboratory tests for routine check-ups and chronic disease management is on the rise. According to recent data, the market for diagnostic testing in the US is projected to reach approximately $85 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5.5%. This trend indicates that clinical reference laboratories are likely to play a crucial role in meeting the increasing demand for accurate and timely diagnostic services.

Growing Prevalence of Chronic Diseases

The clinical reference-laboratories market is significantly influenced by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer. As the population ages and lifestyle-related health issues become more common, the demand for laboratory testing to monitor and manage these conditions is expected to rise. Data indicates that chronic diseases account for approximately 70% of all deaths in the US, underscoring the critical need for effective diagnostic services. Consequently, clinical reference laboratories are likely to expand their testing capabilities to address the growing healthcare needs associated with chronic disease management.

Increased Focus on Preventive Healthcare

There is a marked shift towards preventive healthcare within the clinical reference-laboratories market, driven by both healthcare providers and patients. This focus emphasizes the importance of regular health screenings and early detection of potential health issues. As a result, clinical reference laboratories are expanding their offerings to include a wider range of preventive tests, such as genetic screenings and biomarker assessments. This trend is supported by initiatives aimed at reducing healthcare costs and improving patient outcomes. The preventive healthcare market is projected to grow significantly, which may lead to increased revenue opportunities for clinical reference laboratories.