Aging Population

The Global Dental Radiology and Imaging Devices Market Industry is significantly influenced by the aging population, which tends to require more dental care services. As individuals age, they often face various dental health challenges, including periodontal disease and tooth decay. This demographic shift is prompting dental practices to invest in advanced imaging technologies to cater to the needs of older patients. The increasing prevalence of dental conditions among the elderly population necessitates regular imaging for effective diagnosis and treatment. This trend is expected to bolster market growth, aligning with the anticipated increase in market value to 12.4 USD Billion by 2035.

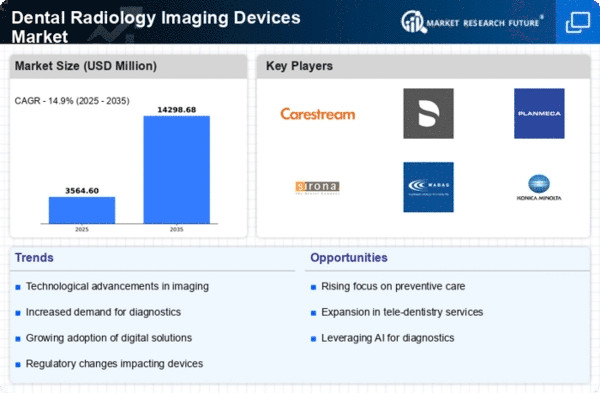

Market Growth Projections

The Global Dental Radiology and Imaging Devices Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 3.1 USD Billion in 2024 and further expand to 12.4 USD Billion by 2035, the industry is on a robust upward trajectory. This growth is underpinned by various factors, including technological advancements, increasing demand for preventive care, and an aging population. The compound annual growth rate (CAGR) of 13.46% from 2025 to 2035 indicates a strong market potential, reflecting the ongoing evolution and expansion of dental imaging technologies.

Technological Advancements

The Global Dental Radiology and Imaging Devices Market Industry is experiencing rapid technological advancements that enhance diagnostic capabilities. Innovations such as digital radiography, 3D imaging, and cone beam computed tomography (CBCT) are becoming increasingly prevalent. These technologies not only improve image quality but also reduce radiation exposure for patients. For instance, digital radiography systems can provide immediate imaging results, facilitating quicker diagnosis and treatment planning. As these technologies evolve, they are expected to drive market growth significantly, contributing to the projected market value of 3.1 USD Billion in 2024 and 12.4 USD Billion by 2035.

Rising Awareness of Oral Health

The Global Dental Radiology and Imaging Devices Market Industry is positively impacted by the rising awareness of oral health among the general population. Educational campaigns and public health initiatives are increasingly emphasizing the importance of regular dental visits and the role of imaging in diagnosing dental issues. This heightened awareness is leading to an increase in patient inquiries about imaging services, thereby driving demand for advanced radiology devices. As more individuals recognize the value of preventive dental care, the market is poised for growth, contributing to the projected CAGR of 13.46% from 2025 to 2035.

Regulatory Support and Standards

The Global Dental Radiology and Imaging Devices Market Industry benefits from regulatory support and established standards that promote the adoption of advanced imaging technologies. Government agencies and dental associations are actively involved in developing guidelines that ensure the safety and efficacy of dental imaging devices. These regulations help instill confidence among dental practitioners and patients regarding the use of modern imaging technologies. As a result, the market is likely to experience steady growth, driven by the assurance that these devices meet stringent safety standards, thereby enhancing their acceptance in clinical settings.

Increasing Demand for Preventive Care

The Global Dental Radiology and Imaging Devices Market Industry is witnessing a surge in demand for preventive dental care. As awareness regarding oral health continues to grow, more patients seek regular dental check-ups that include imaging services. This trend is further supported by initiatives from health organizations promoting preventive care practices. The integration of advanced imaging technologies allows for early detection of dental issues, which can lead to more effective treatment outcomes. Consequently, this increasing demand is likely to contribute to a compound annual growth rate (CAGR) of 13.46% from 2025 to 2035, reflecting the market's potential for expansion.