Rising Cybersecurity Threats

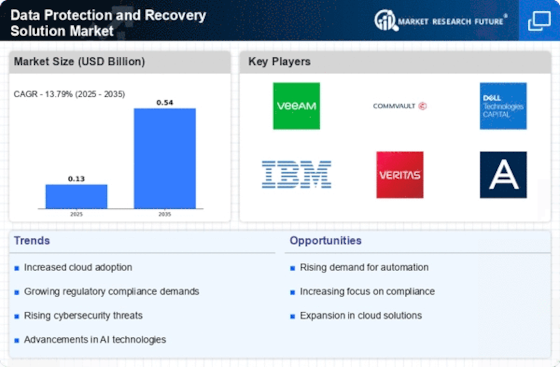

The Data Protection and Recovery Solution Market is experiencing heightened demand due to the increasing frequency and sophistication of cyberattacks. Organizations are compelled to invest in robust data protection solutions to safeguard sensitive information from breaches and ransomware attacks. According to recent statistics, cybercrime is projected to cost businesses trillions annually, underscoring the urgency for effective data recovery strategies. As threats evolve, companies are prioritizing solutions that not only protect data but also ensure rapid recovery in the event of an incident. This trend indicates a growing recognition of the importance of comprehensive data protection frameworks, which are essential for maintaining operational continuity and customer trust.

Emergence of Advanced Technologies

The Data Protection and Recovery Solution Market is witnessing a transformation driven by the emergence of advanced technologies such as artificial intelligence and machine learning. These technologies enhance data protection solutions by enabling predictive analytics, automated threat detection, and streamlined recovery processes. Organizations are increasingly adopting solutions that leverage these technologies to improve their data security posture and reduce recovery times. Market projections suggest that the integration of AI and machine learning in data protection solutions could lead to more proactive and efficient recovery strategies. This trend highlights the industry's shift towards innovative approaches to data protection, positioning it for sustained growth.

Regulatory Compliance Requirements

The Data Protection and Recovery Solution Market is significantly influenced by stringent regulatory compliance requirements imposed on organizations across various sectors. Regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) mandate that businesses implement effective data protection measures. Non-compliance can result in hefty fines and reputational damage, prompting organizations to adopt comprehensive data recovery solutions. The market is witnessing a surge in demand for solutions that not only meet compliance standards but also provide audit trails and reporting capabilities. This trend suggests that organizations are increasingly viewing data protection as a critical component of their compliance strategy, thereby driving growth in the industry.

Increased Data Volume and Complexity

The Data Protection and Recovery Solution Market is being propelled by the exponential growth of data generated by organizations. As businesses increasingly rely on data-driven decision-making, the volume and complexity of data continue to rise. This surge necessitates advanced data protection solutions capable of managing diverse data types across various environments, including on-premises and cloud infrastructures. Market analysis indicates that the data generated worldwide is expected to reach zettabytes in the coming years, creating challenges for traditional data recovery methods. Consequently, organizations are seeking innovative solutions that can efficiently protect and recover vast amounts of data, thereby driving demand in the industry.

Shift Towards Remote Work Environments

The Data Protection and Recovery Solution Market is adapting to the shift towards remote work environments, which has become increasingly prevalent. As organizations embrace flexible work arrangements, the need for secure data access and protection has intensified. Remote work introduces unique challenges, including the potential for data breaches and loss due to unsecured networks. Consequently, businesses are investing in data protection solutions that ensure secure remote access and robust recovery options. This trend indicates a growing recognition of the importance of safeguarding data in a distributed work environment, thereby contributing to the expansion of the data protection and recovery market.