Growing Data Volume

The exponential growth of data generated by organizations significantly drives the data protection recovery solution market. In 2025, it is projected that the total amount of data created will reach 175 zettabytes, necessitating advanced solutions for data management and recovery. As businesses accumulate vast amounts of information, the risk of data loss increases, prompting the need for effective protection strategies. Companies are increasingly recognizing that traditional backup methods may not suffice, leading to a shift towards innovative recovery solutions. This trend suggests that the market will continue to expand as organizations seek to ensure the integrity and availability of their data amidst the challenges posed by data proliferation.

Increased Cloud Adoption

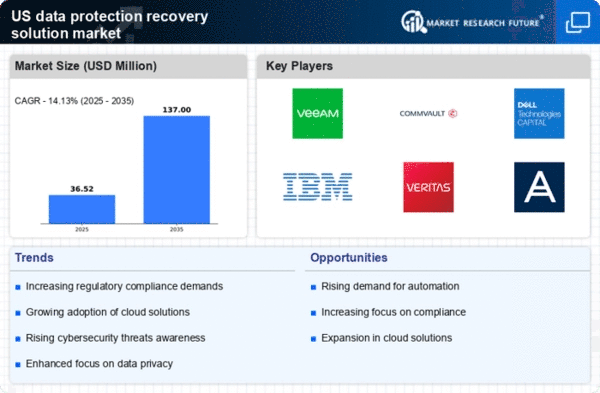

The rapid adoption of cloud computing is reshaping the data protection-recovery-solution market. As organizations migrate to cloud environments, they face new challenges related to data security and recovery. In 2025, it is estimated that over 80% of enterprises will utilize cloud services, creating a pressing need for tailored data protection solutions. Cloud-based recovery options offer flexibility and scalability, appealing to businesses looking to enhance their data resilience. This shift towards cloud solutions indicates a transformation in how organizations approach data protection, driving demand for innovative recovery technologies that align with cloud architectures. The market is likely to see continued growth as companies seek to leverage the benefits of cloud computing while ensuring robust data protection.

Rising Cybersecurity Threats

The data protection-recovery-solution market is experiencing heightened demand due to the increasing frequency and sophistication of cyberattacks. Organizations are compelled to invest in robust data protection strategies to safeguard sensitive information. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, underscoring the urgency for effective recovery solutions. As threats evolve, companies are prioritizing investments in data recovery technologies to mitigate potential losses. This trend indicates a growing recognition of the need for comprehensive data protection measures, driving growth in the market. The emphasis on cybersecurity is likely to continue, as businesses seek to protect their assets and maintain customer trust in an increasingly digital landscape.

Evolving Consumer Expectations

Consumer expectations regarding data privacy and security are evolving, significantly impacting the data protection-recovery-solution market. As awareness of data breaches increases, customers demand transparency and accountability from organizations. In 2025, surveys indicate that over 70% of consumers are concerned about how their data is handled, prompting businesses to prioritize data protection measures. This shift in consumer sentiment is driving companies to invest in comprehensive recovery solutions to build trust and maintain customer loyalty. Organizations that fail to address these expectations may face reputational damage and financial losses. Consequently, the market is likely to expand as businesses seek to align their data protection strategies with consumer demands for enhanced security and privacy.

Technological Advancements in Recovery Solutions

Technological advancements are playing a crucial role in shaping the data protection-recovery-solution market. Innovations such as artificial intelligence, machine learning, and automation are enhancing the efficiency and effectiveness of data recovery processes. In 2025, it is anticipated that AI-driven solutions will account for a significant portion of the market, streamlining recovery operations and reducing downtime. These advancements enable organizations to respond more swiftly to data loss incidents, minimizing potential disruptions. As technology continues to evolve, businesses are likely to adopt more sophisticated recovery solutions, driving growth in the market. The integration of cutting-edge technologies suggests a future where data protection becomes increasingly proactive and resilient.