North America : Innovation and Leadership Hub

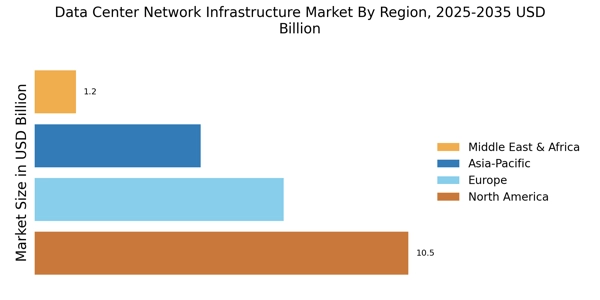

North America leads the Data Center Network Infrastructure Market, holding approximately 45% of the global share, driven by rapid technological advancements and increasing demand for cloud services. The region benefits from a robust regulatory framework that encourages innovation and investment in data centers, particularly in the U.S. and Canada, which are the largest and second-largest markets respectively. The growing emphasis on data security and compliance further fuels market growth.

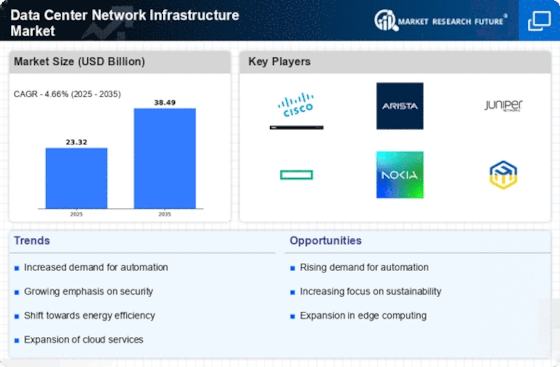

The competitive landscape is characterized by the presence of major players such as Cisco Systems, Arista Networks, and Juniper Networks, which dominate the market with their advanced solutions. The U.S. remains a key player, supported by a strong ecosystem of technology firms and startups. Additionally, the increasing adoption of AI and IoT technologies is expected to drive further growth in the region, making it a focal point for data center investments.

Europe : Emerging Regulatory Frameworks

Europe is witnessing significant growth in the Data Center Network Infrastructure Market, accounting for around 30% of the global share. The region's growth is propelled by stringent regulations aimed at sustainability and energy efficiency, particularly in countries like Germany and the UK, which are the largest and second-largest markets in Europe. The European Union's Green Deal and various national policies are catalyzing investments in green data centers, enhancing the market's appeal.

Leading countries in this region include Germany, the UK, and France, with a competitive landscape featuring key players like Nokia and Hewlett Packard Enterprise. The focus on reducing carbon footprints and improving energy efficiency is driving innovation among local firms. Additionally, the increasing demand for cloud services and data storage solutions is expected to further boost market growth, positioning Europe as a leader in sustainable data center practices.

Asia-Pacific : Rapid Growth and Expansion

Asia-Pacific is rapidly emerging as a significant player in the Data Center Network Infrastructure Market, holding approximately 20% of the global share. The region's growth is driven by increasing internet penetration, the rise of e-commerce, and a growing demand for cloud services. Countries like China and India are leading this growth, with China being the largest market in the region, supported by government initiatives to enhance digital infrastructure and connectivity.

The competitive landscape is marked by the presence of key players such as Huawei Technologies and Dell Technologies, which are expanding their operations to meet the rising demand. The region is also witnessing a surge in investments from both local and international firms, aiming to capitalize on the growing digital economy. As data consumption continues to rise, the Asia-Pacific market is poised for substantial growth in the coming years, driven by technological advancements and increased data center deployments.

Middle East and Africa : Emerging Digital Economy

The Middle East and Africa region is gradually establishing itself in the Data Center Network Infrastructure Market, accounting for about 5% of the global share. The growth is primarily driven by increasing investments in digital infrastructure and a rising demand for data storage solutions. Countries like the UAE and South Africa are leading the market, with the UAE being the largest market in the region, supported by government initiatives to enhance digital capabilities and attract foreign investments.

The competitive landscape is evolving, with local and international players entering the market to capitalize on the growing demand. Key players include companies like Extreme Networks and MikroTik, which are focusing on providing innovative solutions tailored to the region's unique needs. As the digital economy continues to expand, the Middle East and Africa are expected to see significant growth in data center infrastructure, driven by both public and private sector investments.