Emergence of Edge Computing

The rise of edge computing is significantly impacting the converged data-center-infrastructure market. As organizations seek to process data closer to its source, the demand for edge solutions is increasing. This trend is driven by the need for reduced latency, improved performance, and enhanced data security. Recent analyses suggest that the edge computing market could reach a valuation of $15 billion by 2026, indicating a substantial opportunity for growth within the converged data-center-infrastructure market. Companies are likely to invest in infrastructure that supports edge computing capabilities, allowing them to harness the benefits of real-time data processing. This shift may lead to innovative developments in the converged data-center-infrastructure market, as vendors adapt their offerings to meet the evolving needs of businesses.

Increased Focus on Automation

Automation is emerging as a critical driver in the converged data-center-infrastructure market. Organizations are increasingly adopting automated solutions to streamline operations, reduce human error, and enhance overall efficiency. The implementation of automation tools allows for faster deployment of resources and improved management of IT environments. Recent surveys indicate that approximately 60% of IT leaders consider automation a top priority for their infrastructure strategies. This focus on automation is likely to lead to the development of more sophisticated management platforms within the converged data-center-infrastructure market, enabling organizations to optimize their operations and respond more swiftly to changing demands. As automation technologies continue to evolve, they may significantly impact the way data centers are designed and operated.

Rising Demand for Scalability

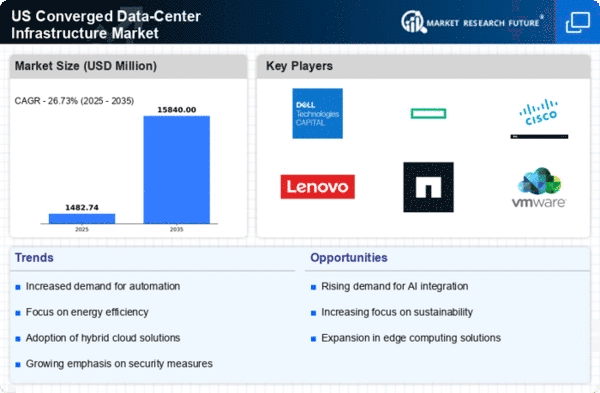

The converged data-center-infrastructure market is experiencing a notable increase in demand for scalable solutions. Organizations are increasingly seeking infrastructure that can grow alongside their business needs. This trend is driven by the necessity for flexibility in resource allocation, allowing companies to adjust their IT capabilities without significant overhauls. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years, indicating a robust appetite for scalable infrastructure. As businesses expand, the ability to seamlessly integrate additional resources into existing systems becomes paramount. This demand for scalability is likely to propel innovations in the converged data-center-infrastructure market, as vendors strive to offer solutions that can accommodate varying workloads and user requirements.

Shift Towards Cloud Integration

The integration of cloud services into the converged data-center-infrastructure market is becoming increasingly prevalent. Organizations are recognizing the benefits of hybrid cloud environments, which combine on-premises infrastructure with cloud resources. This shift is driven by the need for enhanced flexibility, cost efficiency, and improved disaster recovery options. Recent data suggests that nearly 70% of enterprises are planning to adopt hybrid cloud strategies, which will likely influence their infrastructure choices. As a result, vendors in the converged data-center-infrastructure market are focusing on developing solutions that facilitate seamless cloud integration, enabling businesses to leverage the advantages of both on-premises and cloud-based resources. This trend is expected to reshape the competitive landscape, as companies that can effectively bridge these environments may gain a significant edge.

Growing Emphasis on Compliance and Governance

The converged data-center-infrastructure market is increasingly influenced by the need for compliance and governance. As regulatory requirements become more stringent, organizations are compelled to ensure that their data management practices align with legal standards. This emphasis on compliance is driving investments in infrastructure that can support robust governance frameworks. Recent reports indicate that nearly 75% of companies are prioritizing compliance in their IT strategies, which is likely to shape their infrastructure decisions. Vendors in the converged data-center-infrastructure market are responding by offering solutions that incorporate built-in compliance features, enabling organizations to manage their data securely and efficiently. This trend may lead to a more competitive landscape, as companies that can demonstrate compliance capabilities may attract more clients.