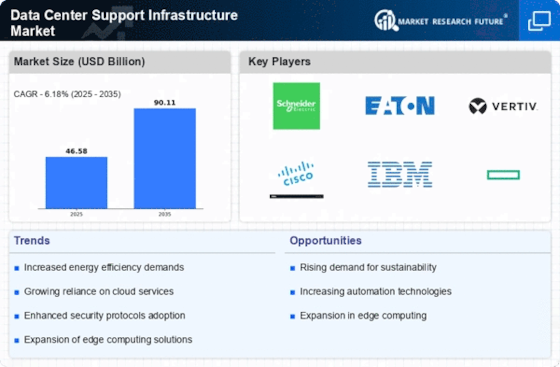

The Data Center Support Infrastructure Market is currently experiencing a transformative phase, driven by the increasing demand for efficient and reliable data management solutions. Organizations are recognizing the necessity of robust infrastructure to support their digital operations, which has led to a surge in investments in advanced technologies. This market encompasses a wide range of components, including power management systems, cooling solutions, and physical security measures, all of which are essential for maintaining optimal performance and reliability in data centers. As businesses continue to expand their digital footprints, the focus on sustainability and energy efficiency is becoming more pronounced, prompting stakeholders to seek innovative solutions that align with environmental goals. The Data Center Support Infrastructure Market forms a critical segment of the broader data center services market, enabling reliable power distribution, cooling, security, and facility management essential for modern digital operations. Growing demand for uptime, energy efficiency, and operational resilience is driving increased adoption of advanced data center support services, including power management, thermal optimization, and AI-enabled monitoring solutions.

In addition, the Data Center Support Infrastructure Market is witnessing a shift towards modular and scalable designs. This trend allows organizations to adapt their infrastructure to changing demands without incurring excessive costs. Furthermore, the integration of artificial intelligence and automation technologies is enhancing operational efficiency, enabling data centers to optimize resource allocation and reduce downtime. As the landscape evolves, collaboration among technology providers, end-users, and regulatory bodies will likely play a crucial role in shaping the future of this market, ensuring that it meets the growing needs of a digital-first world. The shift toward managed and cloud-based deployment models reflects broader transformation across the data center services market, as enterprises prioritize scalability, cost efficiency, and reduced infrastructure complexity. Applications such as enterprise IT, cloud computing, and colocation facilities increasingly rely on specialized data center support services to ensure high availability and performance in mission-critical environments.

Sustainability Initiatives

The emphasis on sustainability within the Data Center Support Infrastructure Market is becoming increasingly pronounced. Organizations are actively seeking solutions that minimize environmental impact, such as energy-efficient cooling systems and renewable energy sources. This trend reflects a broader commitment to corporate social responsibility and aligns with global efforts to combat climate change.

The shift toward managed and cloud-based deployment models reflects broader transformation across the data center services market, as enterprises prioritize scalability, cost efficiency, and reduced infrastructure complexity. Applications such as enterprise IT, cloud computing, and colocation facilities increasingly rely on specialized data center support services to ensure high availability and performance in mission-critical environments.

Modular Infrastructure Solutions

Modular designs are gaining traction in the Data Center Support Infrastructure Market, offering flexibility and scalability. These solutions enable organizations to expand their infrastructure incrementally, accommodating growth without the need for extensive overhauls. This adaptability is particularly appealing in a rapidly changing technological landscape.

Integration of AI and Automation

The incorporation of artificial intelligence and automation technologies is transforming operations within the Data Center Support Infrastructure Market. These advancements facilitate improved resource management, predictive maintenance, and enhanced security measures. As organizations strive for greater efficiency, the role of AI in optimizing data center performance is likely to expand.