Market Growth Projections

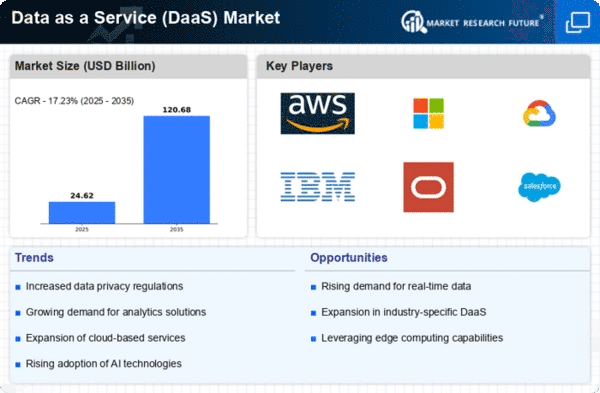

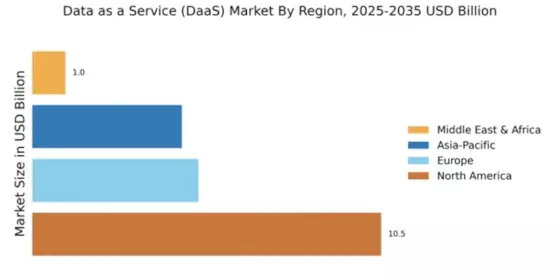

The Global Data as a Service (DaaS) Market Industry is poised for substantial growth, with projections indicating a market size of 21 USD Billion in 2024 and an anticipated expansion to 121.2 USD Billion by 2035. This remarkable growth trajectory reflects a compound annual growth rate (CAGR) of 17.27% from 2025 to 2035. The increasing reliance on data-driven strategies across various sectors, coupled with advancements in cloud technology and data analytics, contributes to this upward trend. As organizations continue to prioritize data accessibility and utilization, the DaaS market is likely to experience robust demand and innovation.

Rising Demand for Data Analytics

The Global Data as a Service (DaaS) Market Industry experiences a notable surge in demand for data analytics solutions. Organizations across various sectors are increasingly recognizing the value of data-driven decision-making. This trend is particularly evident in industries such as finance, healthcare, and retail, where data analytics enhances operational efficiency and customer insights. As a result, the market is projected to reach 21 USD Billion in 2024, reflecting a growing reliance on data analytics to drive business strategies. The emphasis on real-time data access and analysis further propels the adoption of DaaS solutions, positioning the industry for sustained growth.

Emergence of Advanced Technologies

The emergence of advanced technologies, including artificial intelligence and machine learning, plays a crucial role in driving the Global Data as a Service (DaaS) Market Industry. These technologies enable organizations to extract valuable insights from vast datasets, enhancing predictive analytics and decision-making capabilities. As businesses increasingly adopt AI-driven solutions, the demand for DaaS offerings that integrate these technologies is expected to rise. The market's growth is further supported by a projected CAGR of 17.27% from 2025 to 2035, indicating a robust trajectory fueled by the integration of advanced technologies into data services.

Increased Focus on Customer Experience

The Global Data as a Service (DaaS) Market Industry is witnessing a heightened focus on customer experience as organizations strive to understand and meet customer needs effectively. DaaS solutions provide businesses with access to comprehensive customer data, enabling personalized marketing strategies and improved service delivery. Companies are leveraging data insights to enhance customer interactions and build long-term relationships. This trend is likely to drive the adoption of DaaS services, as organizations recognize the importance of data in shaping customer experiences. The growing emphasis on customer-centric approaches positions the DaaS market for continued expansion in the coming years.

Cloud Adoption and Digital Transformation

The ongoing shift towards cloud computing and digital transformation significantly influences the Global Data as a Service (DaaS) Market Industry. Organizations are increasingly migrating their data storage and processing to cloud platforms, driven by the need for scalability, flexibility, and cost-effectiveness. This transition facilitates seamless access to data and enhances collaboration among teams. As businesses embrace digital transformation initiatives, the demand for DaaS solutions is expected to rise. The market's growth trajectory indicates a potential expansion to 121.2 USD Billion by 2035, underscoring the pivotal role of cloud adoption in shaping the future of data services.

Regulatory Compliance and Data Governance

The Global Data as a Service (DaaS) Market Industry is significantly impacted by the increasing emphasis on regulatory compliance and data governance. Organizations are compelled to adhere to stringent data protection regulations, such as GDPR and CCPA, which necessitate robust data management practices. DaaS solutions offer the necessary tools for ensuring compliance while maintaining data integrity and security. As businesses navigate complex regulatory landscapes, the demand for DaaS services that facilitate compliance is likely to grow. This trend not only enhances trust among consumers but also positions organizations to leverage data responsibly, thereby fostering a more sustainable data ecosystem.