Sustainability Initiatives

Sustainability has emerged as a key driver in the Global Data Center Service Market Industry, as organizations increasingly prioritize environmentally friendly practices. Data centers are adopting energy-efficient technologies and renewable energy sources to reduce their carbon footprint. This commitment to sustainability not only aligns with corporate social responsibility goals but also meets the growing demand from consumers for eco-conscious services. As a result, data centers are likely to invest in green technologies, enhancing their appeal in a competitive market. The focus on sustainability is expected to play a crucial role in shaping the future of data center services, influencing investment decisions and operational strategies.

Technological Advancements

Technological advancements are a fundamental driver of the Global Data Center Service Market Industry, as innovations in hardware and software continue to transform data center operations. The integration of cutting-edge technologies, such as virtualization, automation, and artificial intelligence, enhances efficiency and reduces operational costs. These advancements enable data centers to optimize resource allocation and improve service delivery. As organizations seek to leverage these technologies for competitive advantage, the demand for advanced data center services is likely to increase. This trend underscores the importance of continuous investment in technology to maintain relevance in a rapidly evolving market.

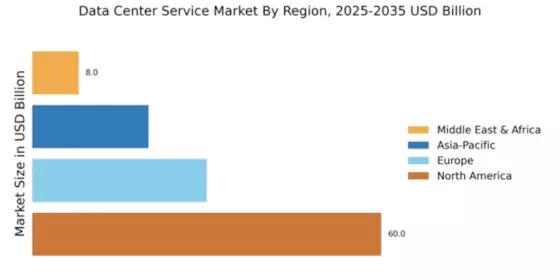

Market Trends and Projections

The Global Data Center Service Market Industry is characterized by several key trends and projections that shape its future landscape. As of 2024, the market value stands at 55.7 USD Billion, with expectations to maintain this figure through 2035. Despite a projected CAGR of 0.0% for the period from 2025 to 2035, the market remains resilient, driven by ongoing demand for data center services. Factors such as cloud adoption, data security concerns, and technological advancements contribute to this stability. The market's trajectory suggests a period of consolidation and adaptation, as service providers align their offerings with evolving customer needs.

Growth of IoT and Edge Computing

The proliferation of Internet of Things (IoT) devices and the emergence of edge computing are reshaping the Global Data Center Service Market Industry. As more devices connect to the internet, the need for localized data processing becomes critical. Edge computing reduces latency and enhances performance, prompting data centers to adapt their infrastructures accordingly. This shift is expected to drive innovation and investment in data center services, as organizations seek to optimize their operations. The market's resilience is evident, with projections indicating a steady value of 55.7 USD Billion from 2024 to 2035, despite a CAGR of 0.0% for the period between 2025 and 2035.

Increased Focus on Data Security

Data security remains a paramount concern for organizations globally, significantly influencing the Global Data Center Service Market Industry. With the rise of cyber threats and stringent regulatory requirements, businesses are compelled to invest in robust data protection measures. Data centers are adapting by implementing advanced security protocols and compliance frameworks to safeguard sensitive information. This heightened focus on security not only enhances customer trust but also drives demand for specialized data center services. As a result, the market is expected to maintain its value at 55.7 USD Billion through 2035, indicating a stable investment in security solutions within data centers.

Rising Demand for Cloud Services

The Global Data Center Service Market Industry experiences a notable surge in demand for cloud services, driven by businesses seeking scalable and flexible IT solutions. As organizations increasingly migrate to cloud platforms, data centers are evolving to accommodate this shift. In 2024, the market is projected to reach 55.7 USD Billion, reflecting the growing reliance on cloud infrastructure. This trend is likely to continue as enterprises prioritize agility and cost-effectiveness in their operations. The integration of advanced technologies, such as artificial intelligence and machine learning, further enhances the capabilities of data centers, making them indispensable in the digital landscape.