Economic Recovery

The Credit Card Market is poised to benefit from ongoing economic recovery trends. As economies stabilize, consumer spending is expected to rise, leading to increased credit card usage. In 2025, projections indicate that credit card spending could grow by 8% compared to previous years, driven by a resurgence in discretionary spending. This recovery is likely to encourage consumers to utilize credit cards for larger purchases, thereby boosting transaction volumes. Additionally, as employment rates improve, more individuals may qualify for credit cards, expanding the customer base for issuers. This economic rebound presents a favorable environment for the Credit Card Market, as increased consumer confidence translates into higher credit card adoption and usage.

Regulatory Changes

Regulatory changes are playing a pivotal role in shaping the Credit Card Market. Governments worldwide are implementing stricter regulations aimed at enhancing consumer protection and promoting transparency in credit card terms. For instance, recent legislation mandates clearer disclosure of fees and interest rates, which could influence consumer choices. In 2025, it is anticipated that compliance with these regulations will require credit card issuers to invest in systems that ensure adherence, potentially increasing operational costs. However, these changes may also foster greater consumer confidence, as individuals become more informed about their credit options. Consequently, the Credit Card Market may experience a shift towards more ethical lending practices, benefiting both consumers and issuers in the long run.

Consumer Behavior Shifts

The Credit Card Market is witnessing notable shifts in consumer behavior, particularly among younger demographics. Millennials and Generation Z are increasingly favoring credit cards that offer rewards and cashback incentives. Data indicates that approximately 60% of consumers aged 18-34 prioritize rewards programs when selecting a credit card. This trend suggests a growing demand for personalized financial products that cater to individual spending habits. Additionally, the rise of e-commerce has led to an increase in online credit card usage, with a reported 40% of consumers using credit cards for online purchases in 2025. As consumer preferences evolve, credit card companies must adapt their offerings to remain competitive in the dynamic landscape of the Credit Card Market.

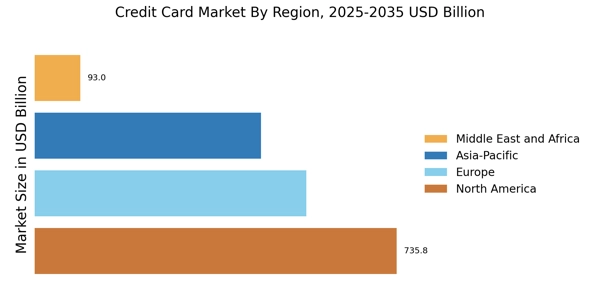

Emerging Markets Expansion

The Credit Card Market is witnessing significant expansion in emerging markets, where financial inclusion initiatives are gaining momentum. Many developing regions are experiencing a surge in credit card adoption as access to banking services improves. In 2025, it is estimated that credit card penetration in these markets could increase by 15%, driven by mobile banking and fintech innovations. This growth presents a unique opportunity for credit card issuers to tap into previously underserved populations. As more consumers gain access to credit, the Credit Card Market is likely to see a diversification of its customer base, with an emphasis on tailored products that meet the needs of diverse demographics. This expansion not only enhances financial accessibility but also contributes to the overall growth of the credit card sector.

Technological Advancements

The Credit Card Market is experiencing a transformative phase driven by rapid technological advancements. Innovations such as contactless payments, mobile wallets, and artificial intelligence are reshaping consumer interactions with credit cards. In 2025, it is estimated that contactless transactions will account for over 30% of all credit card transactions, reflecting a shift towards convenience and speed. Furthermore, the integration of AI in fraud detection systems enhances security, fostering consumer trust. As technology continues to evolve, credit card issuers are likely to invest heavily in digital solutions, thereby expanding their market reach and improving customer experience. This technological evolution not only streamlines transactions but also opens avenues for new services, positioning the Credit Card Market for sustained growth.