E-commerce Growth and Online Shopping Trends

The Credit Card Payment Market is significantly influenced by the ongoing growth of e-commerce and online shopping. As more consumers turn to digital platforms for their purchasing needs, the demand for seamless and secure payment options has surged. In 2025, e-commerce sales are projected to reach approximately 6 trillion dollars, with credit cards remaining a preferred payment method due to their convenience and rewards programs. This trend indicates that the Credit Card Payment Market will continue to expand, as businesses adapt to consumer preferences by offering diverse payment options that cater to the online shopping experience.

Regulatory Changes and Compliance Requirements

The Credit Card Payment Market is subject to evolving regulatory changes and compliance requirements that can significantly impact operations. Governments and regulatory bodies are increasingly focusing on consumer protection, data security, and anti-fraud measures. In 2025, new regulations may emerge that mandate stricter compliance for payment processors and financial institutions, potentially reshaping the competitive landscape. While these regulations aim to enhance consumer trust and security, they may also impose additional costs on businesses within the Credit Card Payment Market. Adapting to these changes will be crucial for maintaining market position and ensuring compliance.

Consumer Demand for Rewards and Loyalty Programs

The Credit Card Payment Market is increasingly driven by consumer demand for rewards and loyalty programs. As individuals seek to maximize the value of their spending, credit card issuers are responding by offering attractive incentives such as cashback, travel rewards, and points systems. In 2025, it is anticipated that over 70% of credit card users will actively participate in some form of rewards program. This trend not only enhances customer satisfaction but also encourages higher spending, thereby contributing to the overall growth of the Credit Card Payment Market. Financial institutions are likely to continue innovating their offerings to retain and attract customers.

Technological Advancements in Payment Processing

The Credit Card Payment Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as contactless payments, mobile wallets, and blockchain technology are reshaping how transactions are conducted. In 2025, it is estimated that contactless payments will account for over 30% of all credit card transactions, reflecting a growing consumer preference for speed and convenience. Furthermore, the integration of artificial intelligence in fraud detection systems enhances security, thereby fostering consumer trust. As technology continues to evolve, the Credit Card Payment Market is likely to witness increased adoption rates, as both consumers and merchants seek efficient and secure payment solutions.

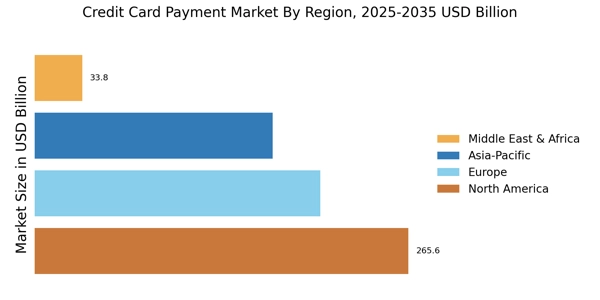

Increasing Global Connectivity and Financial Inclusion

The Credit Card Payment Market is benefiting from increasing global connectivity and efforts towards financial inclusion. As internet access expands and mobile technology becomes more prevalent, previously underserved populations are gaining access to credit card services. In 2025, it is estimated that the number of credit card users in emerging markets will rise significantly, driven by initiatives aimed at promoting financial literacy and access to banking services. This trend not only opens new avenues for growth within the Credit Card Payment Market but also fosters economic development by enabling more individuals to participate in the formal economy.