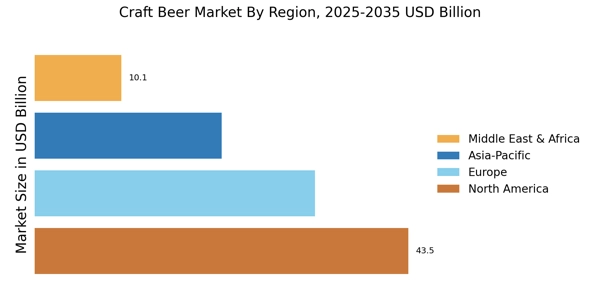

North America : Craft Beer Market Capital of the World

North America remains the largest market for craft beer, accounting for approximately 40% of the global beer market share in us. The region's growth is driven by increasing consumer preference for unique flavors and local products, alongside supportive regulations that encourage small breweries. The U.S. beer market share leads this market, followed closely by Canada, which holds about 10% of the US Craft Beer Market share. The craft beer market USA remains the largest globally, with a US craft beer market share of approximately 40%, led by Anheuser-Busch InBev and Boston Beer Company. The craft beer segment is bolstered by a growing trend towards artisanal and locally sourced beverages. The competitive landscape in North America is vibrant, with key players like Anheuser-Busch InBev, Boston Beer Company, and Sierra Nevada Brewing Co. dominating the scene. The presence of numerous microbreweries and craft beer festivals fosters innovation and consumer engagement. The region's regulatory environment supports craft brewing, with many states offering tax incentives and grants to small breweries, further enhancing market growth. Recent microbrewery statistics reveal remarkable growth across North America, Europe, and Asia-Pacific. The craft beer market Canada is expanding steadily, while niche markets such as Southcentre are seeing localized craft beer adoption.

Europe : Emerging Craft Beer Market Hub

Europe is witnessing a significant rise in the craft beer market, currently holding about 30% of the global share. The growth is fueled by changing consumer preferences towards premium and locally produced beverages, alongside favorable regulations that support small breweries. Europe craft beer market holds around 30% of the global share, with Germany and the UK leading. The France craft beer market is also growing due to consumer preference for artisanal brews. Germany and the UK are the largest markets in Europe, with Germany accounting for approximately 12% and the UK for around 8% of the market share. This trend is expected to continue as consumers seek diverse and innovative beer options. Leading countries in Europe are characterized by a robust competitive landscape, with notable players like Heineken N.V. and Diageo plc. The craft beer scene is thriving, with numerous local breweries emerging, particularly in Germany, the UK, and the Netherlands. The European market is also supported by various craft beer festivals and events that promote local brews, enhancing consumer awareness and engagement. The European Commission emphasizes the importance of supporting small and medium-sized enterprises in the brewing sector.

Asia-Pacific : Emerging Powerhouse in Brewing

The Asia-Pacific region is rapidly emerging as a significant player in the craft beer market, currently holding about 20% of the global share. The growth is driven by increasing disposable incomes, urbanization, and a shift in consumer preferences towards premium and unique beverages. Countries like China and Japan are leading this trend, with China accounting for approximately 10% of the market share, reflecting a growing interest in craft beer among younger consumers seeking diverse flavors. China craft beer market is emerging as a key growth area, driven by younger consumers seeking unique flavors and international collaborations. The competitive landscape in Asia-Pacific is evolving, with both local and international players entering the market. Key players include local breweries and international giants like Molson Coors Beverage Company. The region is witnessing a surge in craft beer festivals and events, which are crucial for promoting local brands and educating consumers about craft beer. Regulatory support is also increasing, with governments recognizing the economic potential of the craft brewing industry. Japan craft beer market and craft beer market Tokyo are witnessing a rise in premium and small-batch offerings targeting urban consumers.

Middle East and Africa : Untapped Potential in Brewing

The Middle East and Africa region is gradually emerging in the craft beer market, currently holding about 10% of the global share. The growth is driven by changing consumer attitudes towards alcohol consumption and a rising interest in craft beverages. Countries like South Africa and Kenya are at the forefront, with South Africa accounting for approximately 5% of the market share. The region's craft beer scene is still developing, but there is significant potential for growth as more consumers seek unique and locally produced options. The competitive landscape is characterized by a mix of local breweries and international brands entering the market. Key players are beginning to establish a presence, and local craft breweries are gaining popularity. The region is also seeing an increase in craft beer festivals, which help to promote local brands and educate consumers. Regulatory frameworks are evolving, with some countries beginning to support the craft brewing industry through favorable policies and incentives.