Expansion of the Biofuel Sector

The Cottonseed Oil Market is likely to experience growth due to the expansion of the biofuel sector. Cottonseed oil can be utilized as a feedstock for biodiesel production, which is gaining traction as a renewable energy source. With increasing governmental support for biofuels and a global push towards reducing carbon emissions, the demand for cottonseed oil as a biofuel feedstock is expected to rise. In 2025, the biofuel market is projected to grow at a rate of 7%, which could significantly impact the Cottonseed Oil Market. This trend not only enhances the economic viability of cottonseed oil but also aligns with sustainability goals, making it an attractive option for energy producers.

Increased Use in Food Processing

The Cottonseed Oil Market is witnessing a surge in its application within the food processing sector. Cottonseed oil is favored for its stability and neutral flavor, making it an ideal choice for frying and baking. In recent years, food manufacturers have increasingly incorporated cottonseed oil into their products, ranging from snacks to baked goods. This trend is reflected in the data, which indicates that the food processing segment accounts for over 30% of the total cottonseed oil consumption. As the demand for processed foods continues to rise, the Cottonseed Oil Market is poised to benefit from this growing trend, potentially leading to increased production and innovation in oil extraction and refining techniques.

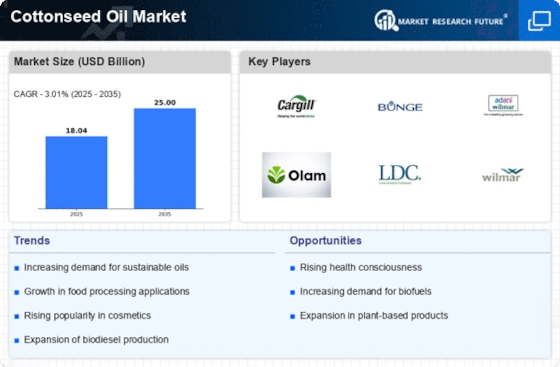

Rising Demand for Plant-Based Oils

The Cottonseed Oil Market is experiencing a notable increase in demand for plant-based oils, driven by a shift in consumer preferences towards healthier and more sustainable food options. As consumers become more health-conscious, they are increasingly opting for oils that are perceived as healthier alternatives to traditional animal fats. Cottonseed oil, known for its light flavor and high smoke point, is gaining traction among both home cooks and professional chefs. In 2025, the market for plant-based oils is projected to grow at a compound annual growth rate of approximately 5.5%, indicating a robust trend that is likely to benefit the Cottonseed Oil Market significantly. This rising demand is further supported by the growing awareness of the health benefits associated with plant-based diets.

Growing Awareness of Nutritional Benefits

The Cottonseed Oil Market is benefiting from a growing awareness of the nutritional benefits associated with cottonseed oil. Rich in polyunsaturated fats and vitamin E, cottonseed oil is increasingly recognized for its potential health advantages, including heart health and antioxidant properties. As consumers become more informed about the nutritional profiles of cooking oils, cottonseed oil is likely to gain popularity among health-conscious individuals. Market Research Future indicates that the health and wellness trend is influencing purchasing decisions, with consumers actively seeking oils that offer health benefits. This shift in consumer behavior is expected to bolster the Cottonseed Oil Market, as more individuals incorporate cottonseed oil into their diets.

Technological Advancements in Oil Extraction

The Cottonseed Oil Market is poised for growth due to technological advancements in oil extraction and refining processes. Innovations in extraction techniques, such as cold pressing and solvent extraction, have improved the efficiency and yield of cottonseed oil production. These advancements not only enhance the quality of the oil but also reduce production costs, making cottonseed oil more competitive in the market. As technology continues to evolve, the Cottonseed Oil Market is likely to benefit from increased production capabilities and improved product quality. Furthermore, these advancements may lead to the development of new applications for cottonseed oil, expanding its market reach and potential.