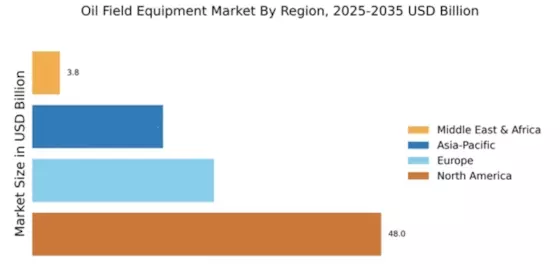

North America : Market Leader in Oil Equipment

North America continues to lead the oil field equipment market, holding a significant share of 48.0% in 2024. The region's growth is driven by increasing oil production, technological advancements, and supportive regulatory frameworks. The demand for efficient and innovative equipment is rising, fueled by the need for enhanced extraction techniques and sustainability initiatives. Regulatory support for energy independence further catalyzes market expansion. The United States is the primary player in this region, hosting major companies like Schlumberger, Halliburton, and Baker Hughes. These firms are at the forefront of technological innovation, providing advanced solutions to meet the growing demands of the oil sector. The competitive landscape is characterized by strategic partnerships and mergers, enhancing operational efficiencies and market reach. The presence of key players solidifies North America's position as a powerhouse in the oil field equipment market.

Europe : Emerging Market with Growth Potential

Europe's oil field equipment market is poised for growth, currently holding a market size of 25.0%. The region is experiencing a shift towards renewable energy sources, yet the demand for oil remains significant. Regulatory frameworks aimed at reducing carbon emissions are driving innovation in equipment efficiency and sustainability. The ongoing investments in oil exploration and production technologies are expected to bolster market growth in the coming years. Leading countries in this region include the UK, Norway, and Germany, where companies like TechnipFMC and Aker Solutions are key players. The competitive landscape is marked by a focus on technological advancements and strategic collaborations. As Europe navigates its energy transition, the oil field equipment market is adapting to meet both traditional and emerging energy needs. The European Commission emphasizes the importance of innovation in this sector, stating that "the energy transition must be supported by advanced technologies and sustainable practices."

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing rapid growth in the oil field equipment market, with a market size of 18.0%. This growth is driven by increasing energy demands, particularly in countries like China and India, where industrialization and urbanization are accelerating. Regulatory support for energy security and investments in oil exploration are further propelling market expansion. The region's focus on enhancing production efficiency is also a key driver of demand for advanced equipment. China and India are the leading countries in this market, with significant investments in oil and gas infrastructure. The competitive landscape features both local and international players, including major firms like Baker Hughes and Weatherford International. As the region continues to develop its energy resources, the presence of key players and their innovative solutions will be crucial in meeting the growing demands of the oil field equipment market.

Middle East and Africa : Resource-Rich Yet Challenging Market

The Middle East and Africa region, with a market size of 3.8%, presents unique challenges and opportunities in the oil field equipment market. The region is rich in oil reserves, driving demand for advanced equipment. However, geopolitical instability and regulatory hurdles can impact market growth. Efforts to diversify economies and invest in infrastructure are essential for enhancing the oil sector's resilience and sustainability. Leading countries in this region include Saudi Arabia and Nigeria, where significant investments in oil production are ongoing. The competitive landscape is characterized by a mix of local and international players, with companies like Oceaneering International and Cameron International making notable contributions. As the region navigates its complexities, the focus on innovation and efficiency will be vital for sustaining growth in the oil field equipment market.