Health and Wellness Trends

The ongoing health and wellness movement significantly influences the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market. Consumers are increasingly seeking natural ingredients that offer health benefits, such as medium-chain triglycerides found in coconut oil. These fatty acids are associated with various health advantages, including improved metabolism and enhanced energy levels. Market data indicates that the demand for natural fatty acids is expected to rise, driven by their incorporation into dietary supplements and functional foods. This trend not only reflects a shift in consumer preferences but also suggests that manufacturers in the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market may need to innovate their product offerings to meet evolving health standards.

Sustainability Initiatives

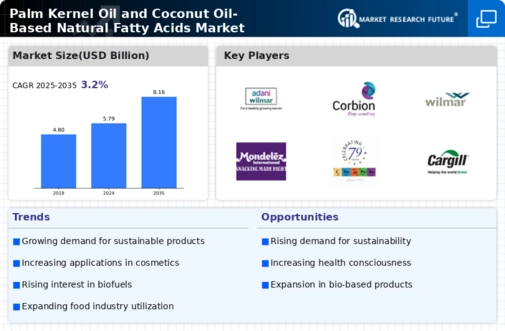

The increasing emphasis on sustainability appears to be a pivotal driver for the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market. As consumers and manufacturers alike become more environmentally conscious, there is a growing demand for natural and biodegradable products. This trend is reflected in the rising preference for palm kernel oil and coconut oil, which are derived from renewable resources. According to recent data, the market for natural fatty acids is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This shift towards sustainable sourcing not only enhances brand reputation but also aligns with regulatory frameworks aimed at reducing environmental impact, thereby propelling the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market forward.

Expanding Industrial Applications

The versatility of palm kernel oil and coconut oil-based natural fatty acids is driving their adoption across various industrial applications. Industries such as food, cosmetics, and pharmaceuticals are increasingly incorporating these natural fatty acids into their formulations. The food industry, in particular, is experiencing a surge in demand for natural emulsifiers and stabilizers derived from these oils. Market Research Future indicate that the food sector is expected to grow at a rate of 4% annually, contributing significantly to the overall growth of the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market. This expanding application base suggests that manufacturers must remain agile and responsive to the diverse needs of different sectors.

Innovations in Production Techniques

Technological advancements in production techniques are emerging as a crucial driver for the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market. Innovations such as enzymatic processes and green chemistry are enhancing the efficiency and sustainability of fatty acid production. These methods not only reduce waste but also improve the quality of the final products. As manufacturers adopt these advanced techniques, they are likely to achieve cost savings and meet the increasing regulatory demands for environmentally friendly practices. Market forecasts suggest that the adoption of innovative production methods could lead to a 10% reduction in production costs, thereby positively impacting the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market.

Rising Demand in Personal Care Products

The personal care sector is witnessing a notable increase in the utilization of natural ingredients, which serves as a significant driver for the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market. With consumers becoming more aware of the ingredients in their personal care products, there is a marked shift towards formulations that include natural fatty acids. These ingredients are valued for their moisturizing properties and skin compatibility. Recent market analysis suggests that the personal care segment is projected to account for a substantial share of the overall fatty acids market, potentially exceeding 30% by 2026. This trend indicates that companies within the Palm Kernel Oil and Coconut Oil-Based Natural Fatty Acids Market must adapt to these consumer preferences to maintain competitiveness.

Leave a Comment