Cooking Oils Fats Market Summary

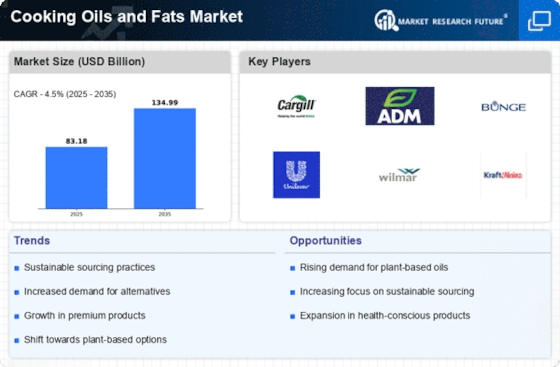

As per Market Research Future analysis, the Cooking Oils and Fats Market Size was estimated at 83.18 USD Billion in 2024. The Cooking Oils and Fats industry is projected to grow from 86.93 USD Billion in 2025 to 134.99 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Cooking Oils and Fats Market is experiencing a dynamic shift towards health-conscious and sustainable options.

- Health-conscious consumers are increasingly opting for oils that promote wellness and nutrition.

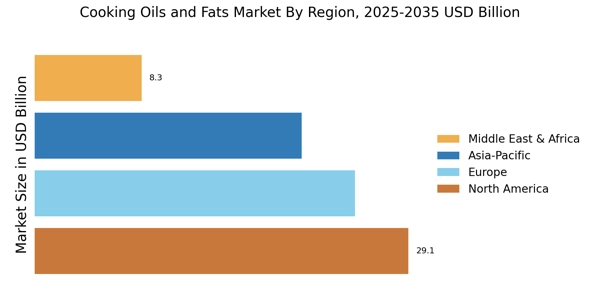

- Sustainability and ethical sourcing are becoming pivotal in consumer purchasing decisions, particularly in North America.

- Innovation in product offerings is driving market growth, with a notable rise in plant-based oils.

- Rising demand for plant-based oils and increased use in food processing are key drivers propelling the market forward.

Market Size & Forecast

| 2024 Market Size | 83.18 (USD Billion) |

| 2035 Market Size | 134.99 (USD Billion) |

| CAGR (2025 - 2035) | 4.5% |

Major Players

Cargill (US), Archer Daniels Midland (US), Bunge (US), Unilever (GB), Wilmar International (SG), Kraft Heinz (US), SABIC (SA), Mewah International (SG), Adani Wilmar (IN)