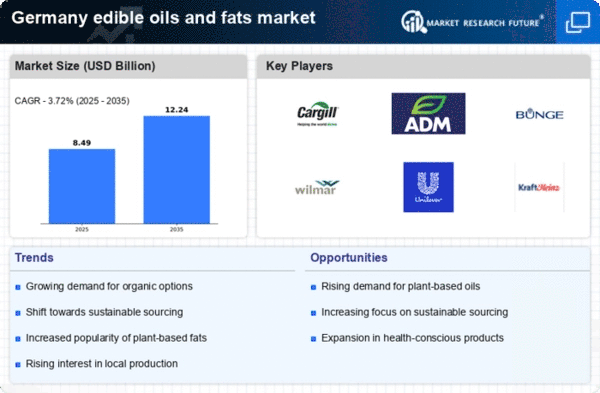

The edible oils-fats market in Germany is characterized by a competitive landscape that is both dynamic and multifaceted. Key growth drivers include increasing consumer demand for healthy and sustainable products, alongside a rising trend towards plant-based diets. Major players such as Cargill (US), Bunge (US), and Unilever (GB) are strategically positioned to leverage these trends. Cargill (US) focuses on innovation in product development, particularly in the realm of plant-based oils, while Bunge (US) emphasizes supply chain optimization and sustainability initiatives. Unilever (GB) is actively pursuing digital transformation to enhance consumer engagement and streamline operations. Collectively, these strategies contribute to a competitive environment that is increasingly shaped by sustainability and technological advancements.In terms of business tactics, companies are localizing manufacturing to reduce transportation costs and enhance supply chain efficiency. The market structure appears moderately fragmented, with several key players holding substantial market shares. This fragmentation allows for a diverse range of products and innovations, while also fostering competition among established and emerging brands. The collective influence of these key players is significant, as they drive trends and set benchmarks for quality and sustainability in the market.

In October Cargill (US) announced a partnership with a leading German food technology firm to develop innovative plant-based oil solutions aimed at reducing environmental impact. This strategic move underscores Cargill's commitment to sustainability and positions the company to capitalize on the growing demand for eco-friendly products. The collaboration is expected to enhance Cargill's product portfolio and strengthen its market presence in Germany.

In September Bunge (US) launched a new line of organic oils, responding to the increasing consumer preference for organic and non-GMO products. This initiative not only diversifies Bunge's offerings but also aligns with the broader market trend towards health-conscious consumption. The introduction of organic oils is likely to attract a new customer segment, thereby enhancing Bunge's competitive edge in the market.

In August Unilever (GB) unveiled a digital platform aimed at improving supply chain transparency and consumer engagement. This platform allows consumers to trace the origin of their oils, thereby fostering trust and loyalty. Unilever's investment in digital technology reflects a broader trend in the industry towards transparency and consumer empowerment, which is becoming increasingly important in the decision-making process of health-conscious consumers.

As of November current competitive trends in the edible oils-fats market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies seek to enhance their capabilities and market reach. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift indicates a future where companies that prioritize sustainable practices and technological advancements will likely lead the market.