Emergence of IoT Devices

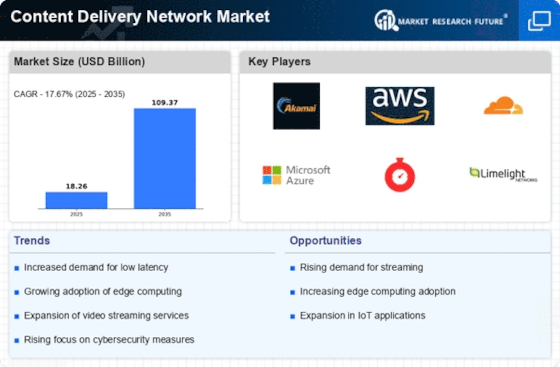

The rapid emergence of Internet of Things (IoT) devices is reshaping the landscape of the Content Delivery Network Market. As more devices become interconnected, the volume of data generated is escalating, necessitating efficient content delivery solutions. By 2025, the number of connected IoT devices is projected to reach 30 billion, creating a substantial demand for CDNs that can handle diverse data types and ensure timely delivery. This trend suggests that businesses must adopt CDNs to manage the complexities associated with IoT data traffic. Consequently, the Content Delivery Network Market is likely to experience growth as organizations seek to optimize their content delivery strategies in response to the IoT revolution.

Rising E-commerce Activities

The surge in e-commerce activities has been a pivotal driver for the Content Delivery Network Market. As online shopping continues to gain traction, businesses are increasingly reliant on CDNs to ensure fast and reliable delivery of content. In 2025, the e-commerce sector is projected to reach a valuation of over 6 trillion USD, necessitating robust CDN solutions to handle the influx of traffic and data. This demand for seamless user experiences compels retailers to invest in CDNs, which can optimize website performance and reduce latency. Consequently, the Content Delivery Network Market is likely to witness substantial growth as more companies seek to enhance their online presence and customer satisfaction through efficient content delivery.

Growth of Video Streaming Platforms

The proliferation of video streaming platforms has significantly influenced the Content Delivery Network Market. With the increasing consumption of video content, platforms are compelled to deliver high-quality streaming experiences. In 2025, the video streaming market is expected to surpass 100 billion USD, driving the need for CDNs that can support high bandwidth and low latency. This trend indicates that content providers must leverage CDNs to manage large volumes of data and ensure uninterrupted service. As a result, the Content Delivery Network Market is poised for expansion, as providers seek to enhance their infrastructure to accommodate the growing demand for video content.

Demand for Enhanced Security Features

The rising demand for enhanced security features is a critical driver for the Content Delivery Network Market. As cyber threats become more sophisticated, organizations are increasingly seeking CDNs that offer robust security measures, such as DDoS protection and data encryption. In 2025, the cybersecurity market is projected to exceed 300 billion USD, indicating a strong correlation between security needs and CDN adoption. This trend suggests that businesses must prioritize secure content delivery to protect sensitive information and maintain customer trust. Consequently, the Content Delivery Network Market is likely to expand as organizations invest in CDNs that provide comprehensive security solutions.

Increased Focus on Digital Transformation

The ongoing digital transformation across various sectors is a significant driver for the Content Delivery Network Market. Organizations are increasingly adopting digital solutions to enhance operational efficiency and customer engagement. In 2025, the digital transformation market is anticipated to reach 2 trillion USD, prompting businesses to invest in CDNs to support their digital initiatives. This investment is crucial for ensuring that content is delivered swiftly and securely, thereby improving user experiences. As companies prioritize digital strategies, the Content Delivery Network Market is expected to flourish, driven by the need for reliable and scalable content delivery solutions.