Top Industry Leaders in the Content Delivery Network Market

Competitive Landscape of Content Delivery Network Market

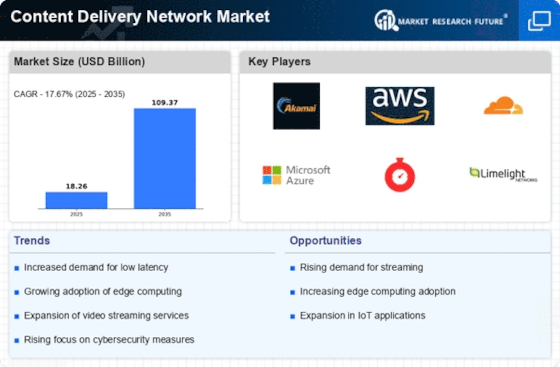

The Content Delivery Network (CDN) market is a rapidly evolving landscape characterized by intense competition and constant innovation. With the exponential growth of internet traffic driven by streaming services, online gaming, and social media, the demand for efficient content delivery solutions is surging. This has attracted a multitude of players, both established and emerging, to compete for market share.

Key Players:

- Akamai Technologies

- Amazon Web Services.

- International Business Machines Corp.

- Limelight Networks

- Verizon

- AT&T Intellectual Property

- Google LLC

Strategies Adopted:

- Geographic expansion: Players are aggressively expanding their global network of servers to ensure optimal content delivery across regions.

- Technology innovation: Continuous investments are made in developing advanced technologies like edge computing and intelligent caching to optimize performance and security.

- Content optimization: Players are offering services like image optimization and video encoding to reduce bandwidth consumption and improve user experience.

- Verticalization: Some players are focusing on specific industries like media and gaming, offering tailored solutions to meet their unique needs.

- Pricing strategies: Players are adopting flexible pricing models, such as pay-as-you-go and tiered pricing, to cater to diverse customer requirements.

Factors for Market Share Analysis:

- Global reach and network size: A larger network allows for faster content delivery and better coverage across regions.

- Performance and reliability: Low latency, high availability, and consistent performance are crucial factors for customer satisfaction.

- Security features: Robust security measures are essential to protect content from cyberattacks and data breaches.

- Scalability and flexibility: The ability to handle traffic spikes and adapt to changing customer needs is crucial for success.

- Customer service and support: Responsive and reliable customer support is essential for building and retaining customer loyalty.

New and Emerging Companies:

- Fastly: A rapidly growing player focused on edge computing and offering highly customizable solutions.

- Cloudflare: A popular CDN provider known for its ease of use and affordable pricing.

- StackPath: An emerging player offering a range of CDN solutions and security services.

- DDoS-Guard: A specialized player offering high-performance CDN solutions with DDoS mitigation capabilities.

Current Company Investment Trends:

- Focus on edge computing: Companies are heavily investing in edge computing technologies to provide faster content delivery and lower latency.

- Integration with cloud platforms: Players are integrating their CDN solutions with major cloud platforms to offer a more comprehensive offering.

- Development of innovative features: Companies are constantly developing new features like AI-powered content optimization and real-time analytics.

- Focus on emerging markets: Companies are paying close attention to fast-growing markets like Asia and Africa to capture new opportunities.

Latest Company Updates:

July 2023 - Akamai, leading content delivery network has introduced 3 cloud computing sites in France and the US with more coming up in India and the US. The company has announced novel instances, made the capacity double of its object storage product to 1 petabyte & 1 billion objects per bucket. This is not the end. Later this year, the company is all set to unveil a load balancing service as well. The latest cloud sites will get located in the colocation facilities.

Akamai stated that the new sites will mark the foremost step in the company’s push for putting storage, compute, database & other services above the same underlying backbone which power its Edge network worldwide. This is amid the first content delivery networks that was originally developed during the ending of the last century for speeding up the internet pages for the users and currently has about 4,100 locations across 135 countries where they place racks of equipment for supporting the local delivery of content.

Having made its foray in February this year, the Connected Cloud of Akamai is intended as a further distributed substitute to the likes both of Azure and AWS. It provides shared and dedicated CPU, containers, GPU, database, storage, and also serverless services.

The services get delivered from expanded set of locations away from the initial 11 sites the company took over. Akamai has promised in driving down the price of cloud computing with lower egress charges resting on bringing the CDN-like economies into the cloud data transfer.