Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Contact Center Analytics Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Contact Center Analytics industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Contact Center Analytics industry to benefit clients and increase the market sector. In recent years, the Contact Center Analytics industry has offered some of the most significant advantages to medicine.

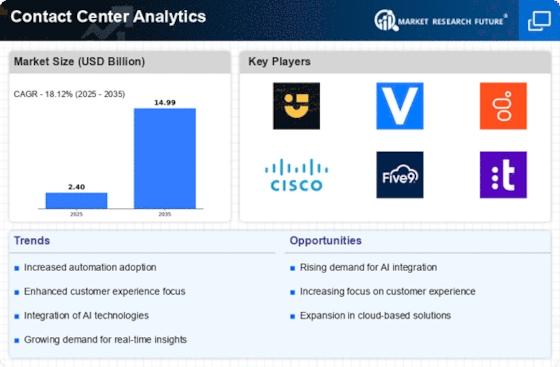

Major players in the Contact Center Analytics Market, including Oracle Corporation, SAP SE, NICE Ltd., Genpact Limited, Genesys, 8X8 Inc., Cisco Systems, Inc., Enghouse Interactive, Servion Global Solutions, Verint Systems Inc., Mitel Networks Corporation, Five9, Inc., CallMiner, and others, are attempting to increase market demand by investing in research and development operations.

Intent-based solutions for networking, security, collaboration, apps, and the cloud are integrated by Cisco Systems Inc (Cisco). The company sells wireless equipment, controllers, access points, switches, modules, routers, and interfaces. The company's products and technology assist its customers in managing additional network connections from devices, users, and other entities. Oil and gas, education, financial services, government, healthcare, mining, sports, media, entertainment, retail, utilities, and transportation are just a few of the many industries that Cisco supports. Through its direct sales team and channel partners, which include service providers, system integrators, distributors, and resellers, it markets its solutions.

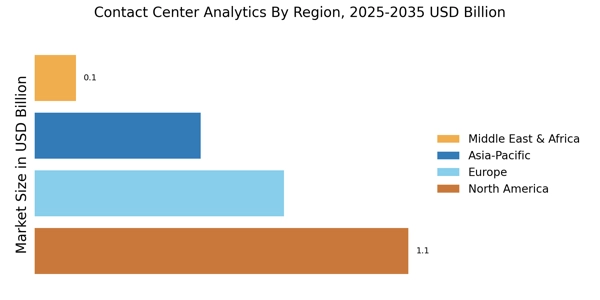

Across the Americas, Europe, the Middle East, Africa, Asia-Pacific, Japan, and China, the company has business and operational presence. The US state of California is home to Cisco's corporate headquarters.

Enterprises can get cloud-based solutions from Oracle Corp (Oracle). The business provides hardware systems, application software, cloud infrastructure software, database and middleware software, and hardware. Additionally, it provides integrated cloud solutions, such as Software as a Service (SaaS) and Infrastructure as a Service (IaaS). Oracle offers licence updates, new licences, and solutions for related support for new On-Site applications. Through independent software and hardware manufacturers, system integrators, and resellers, the corporation distributes its solutions. Hardware, servers, storage, networking, and industry-specific devices are among its On-Site offerings, along with related support and services.

Asia-Pacific, Europe, the Middle East, and the Americas are all regions in which the corporation operates. In the US, Austin, Texas, serves as the home base for Oracle.