Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is reshaping the landscape of the contact center-analytics market. Organizations are increasingly migrating their analytics operations to the cloud to benefit from scalability, flexibility, and cost-effectiveness. Cloud solutions allow for easier integration with existing systems and facilitate remote access to analytics tools. Recent statistics reveal that the cloud-based analytics market is expected to grow by 30% annually, driven by the need for businesses to adapt to changing operational environments. This trend suggests that the contact center-analytics market will continue to evolve as more organizations embrace cloud technologies for their analytics needs.

Integration of Advanced Analytics Tools

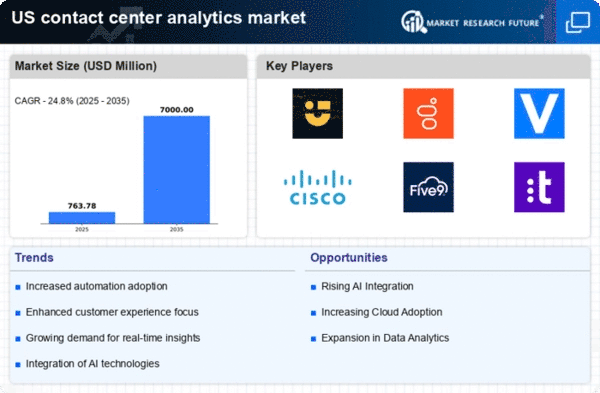

The integration of advanced analytics tools into the contact center-analytics market is becoming increasingly prevalent. Organizations are adopting sophisticated technologies such as predictive analytics and machine learning to gain deeper insights into customer interactions. This shift is indicative of a broader trend where businesses aim to leverage data for strategic decision-making. Reports suggest that the market for predictive analytics in customer service is projected to grow at a CAGR of 25% over the next five years. This growth reflects the potential of advanced analytics to transform customer service operations, enabling organizations to anticipate customer needs and optimize their responses accordingly.

Increased Focus on Workforce Optimization

Workforce optimization is becoming a pivotal focus within the contact center-analytics market. Companies are recognizing that optimizing their workforce can lead to improved efficiency and reduced operational costs. By utilizing analytics to assess employee performance and customer interactions, organizations can identify training needs and enhance overall productivity. Data shows that businesses implementing workforce optimization strategies can achieve up to 20% reductions in operational costs. This trend indicates a growing recognition of the importance of analytics in managing human resources effectively, thereby driving growth in the contact center-analytics market.

Rising Importance of Real-Time Data Processing

Real-time data processing is emerging as a critical driver in the contact center-analytics market. Businesses are increasingly seeking solutions that allow them to analyze customer interactions as they occur, enabling immediate responses to customer inquiries. This capability is essential for maintaining competitive advantage in a fast-paced market. Data indicates that organizations utilizing real-time analytics can improve their response times by up to 50%, significantly enhancing customer satisfaction. As the demand for instantaneous service continues to rise, the contact center-analytics market is likely to see a corresponding increase in the adoption of real-time analytics solutions.

Growing Demand for Enhanced Customer Experience

The contact center-analytics market is experiencing a notable surge in demand for enhanced customer experience. Organizations are increasingly recognizing that superior customer interactions can lead to higher retention rates and increased revenue. According to recent data, companies that prioritize customer experience can achieve up to 60% higher profits than their competitors. This trend is driving investments in analytics tools that provide insights into customer behavior and preferences. By leveraging these insights, businesses can tailor their services to meet customer needs more effectively. As a result, the contact center-analytics market is likely to expand as organizations seek to implement solutions that enhance customer satisfaction and loyalty.