Growing Focus on Sustainability

Sustainability has emerged as a critical driver in the Construction IoT Market. Stakeholders are increasingly prioritizing eco-friendly practices and resource-efficient technologies. IoT solutions facilitate the monitoring of energy consumption, waste management, and material usage, enabling construction firms to minimize their environmental footprint. Reports indicate that projects utilizing IoT technologies can achieve up to a 25% reduction in energy consumption. This growing focus on sustainability not only aligns with The Construction IoT Industry, attracting environmentally conscious clients.

Advancements in Sensor Technology

Technological advancements in sensor technology are propelling the Construction IoT Market forward. The development of more sophisticated sensors enables the collection of precise data regarding environmental conditions, equipment status, and worker safety. These innovations facilitate proactive measures to mitigate risks and enhance productivity. For instance, the deployment of smart sensors can lead to a 20% increase in operational efficiency. As sensor technology continues to evolve, it is likely to play a pivotal role in the ongoing transformation of the Construction IoT Market, fostering a more connected and efficient construction ecosystem.

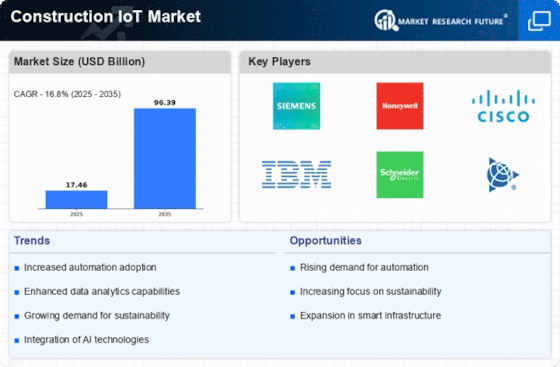

Increased Demand for Real-Time Data

The Construction IoT Market experiences a notable surge in demand for real-time data analytics. This trend is driven by the need for enhanced decision-making processes and operational efficiency on construction sites. Companies are increasingly adopting IoT solutions to monitor equipment performance, track project progress, and manage resources effectively. According to recent estimates, the integration of IoT technologies can lead to a reduction in project delays by up to 30%. This demand for real-time insights is reshaping the Construction IoT Market, as stakeholders seek to leverage data for improved project outcomes and cost management.

Regulatory Compliance and Standards

The Construction IoT Market is significantly influenced by the increasing emphasis on regulatory compliance and industry standards. Governments and regulatory bodies are establishing guidelines that mandate the use of IoT technologies to ensure safety, efficiency, and environmental sustainability in construction projects. Compliance with these regulations not only enhances safety but also promotes the adoption of innovative technologies. As a result, companies that integrate IoT solutions to meet regulatory requirements may experience a competitive advantage. This trend underscores the importance of regulatory frameworks in shaping the future of the Construction IoT Market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) within the Construction IoT Market is transforming operational capabilities. AI algorithms analyze vast amounts of data collected from IoT devices, providing actionable insights that enhance project management and predictive maintenance. This synergy between AI and IoT can lead to improved resource allocation and reduced downtime. Industry forecasts suggest that the combination of AI and IoT technologies could result in a 15% increase in project efficiency. As AI continues to evolve, its role in the Construction IoT Market is expected to expand, driving innovation and operational excellence.