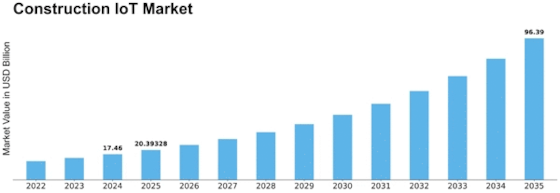

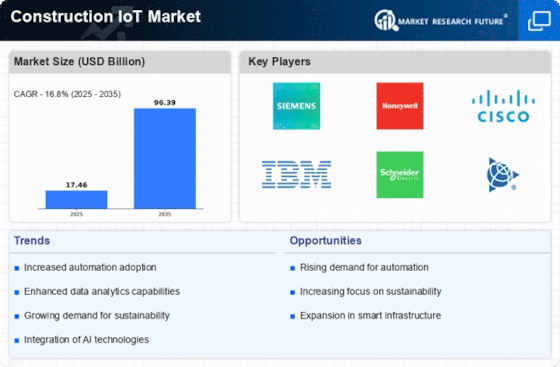

Construction Iot Size

Construction IoT Market Growth Projections and Opportunities

The Construction IoT market is undergoing deanship the fast, being propelled by a versatile range of factors that determine their development. The construction business, on the other hand, is the critical point affecting the creation of the construction IoT market. There is a growing trend towards deployment of integrated and connected features in construction. Currently, the construction sector are facing an upraised demand for the high tech complex system which can able to increase the efficiency, provide safety, and also to manage the whole projects. IoT solution provides live streams, data analytics, and works automatically, enabling construction companies to gain access to the important information and functioning of their operations.

The growing demand for sustainable construction by the means of green processes is another key factor of the market. With a globe going towards environmental conservation and efficiency in the usage of resources, the construction industry has resorted to the Internet of Things tech to optimize energy consumption, reduce wastage, and improve sustainability. The advancement of smart building systems which, in turn, allows for effective energy management through automated and predictive analytics as a result of the implementation of the internet of things (IoT) helps contribute and promote greener initiatives in the construction industry as a whole.

Additionally, the joined-up use of BIM and the boosters of the Internet of Things (IoT) facilitate the growth of the green market. BIM helps to create and manage digital simulations mapping the different aspects of physical buildings and their appropriate relationships in order to ensure real time information sharing and collaborative work environment among different stakeholders involved in a construction project. Combining the sensors of the Internet of Things (IoT) into the BIM scheme allows for collecting the data in real time and making better decisions, making the tasks smoother, and getting better project outcomes.

Continuing to keep costs of IoT within the advisable limit is equally important as it is a player determining the number of adopters of the IoT in the construction industry. The use of IoT sensors to monitor machines and bill of material usage, and optimize asset allocation can lead to an incredible cost reduction. The construction businesses are now more aware of the fact that spending money on installing IoT solutions could in the long term bring a financial reward as these systems can minimise downtime, the need for rework and improve overall project efficiency.

Additionally, the development of the safety codes and the regulations in IoT issues is also a context for the IoT to be used in construction. Governments and their regulators aim to protect occupational safety by imposing the strictest of regulations. IoT-managed safety techniques, such as; equipment of beacons, and nano sensors integrate within the system for distribution of information in real-time mode to confirm adherence to the safety process, and warning burst in case of emergency occurrence. This, not only makes construction jobs safer but also facilitates businesses to navigate within regulatory frameworks.

Leave a Comment