Integration with 5G Networks

The integration of Narrowband-IoT with emerging 5G networks is poised to drive the Narrowband-IoT Market forward. As 5G technology rolls out, it offers enhanced bandwidth and lower latency, which can significantly benefit Narrowband-IoT applications. This synergy is likely to enable more sophisticated use cases, such as real-time monitoring and advanced analytics. The potential for 5G to support a higher density of connected devices complements the capabilities of Narrowband-IoT, making it an attractive option for industries looking to leverage next-generation connectivity. Analysts suggest that this integration could lead to a substantial increase in the deployment of Narrowband-IoT solutions across various sectors.

Growing Adoption of IoT Devices

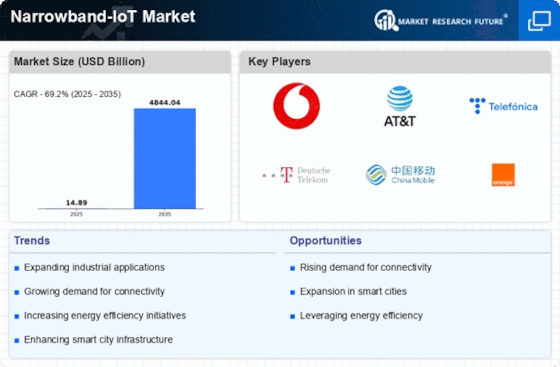

The increasing proliferation of Internet of Things (IoT) devices is a primary driver for the Narrowband-IoT Market. As more devices become interconnected, the demand for efficient communication technologies rises. Narrowband-IoT, with its ability to support a vast number of low-power devices, appears to be well-suited for this trend. According to recent estimates, the number of connected IoT devices is projected to reach over 30 billion by 2030. This surge necessitates robust connectivity solutions, and Narrowband-IoT is positioned to fulfill this requirement, enabling seamless communication across various applications, including smart metering, asset tracking, and environmental monitoring.

Rising Focus on Smart Agriculture

The increasing emphasis on smart agriculture is a notable driver for the Narrowband-IoT Market. As agricultural practices evolve, there is a growing need for technologies that can enhance productivity and resource management. Narrowband-IoT facilitates the deployment of sensors and devices that monitor soil conditions, crop health, and weather patterns, thereby enabling farmers to make informed decisions. Market Research Future indicate that the smart agriculture sector is expected to grow significantly, with investments in IoT solutions projected to reach billions in the next few years. This trend underscores the importance of Narrowband-IoT in supporting sustainable agricultural practices and optimizing yields.

Demand for Low-Power Wide-Area Networks

The demand for Low-Power Wide-Area Networks (LPWAN) is a significant driver for the Narrowband-IoT Market. As industries seek to deploy solutions that require minimal energy consumption while maintaining long-range connectivity, Narrowband-IoT emerges as a viable option. This technology is designed to operate efficiently in environments where traditional cellular networks may falter. Market data indicates that the LPWAN segment is expected to witness substantial growth, with Narrowband-IoT accounting for a considerable share due to its cost-effectiveness and scalability. This trend is particularly evident in sectors such as agriculture, logistics, and smart infrastructure, where long-range communication is essential.

Regulatory Support for IoT Technologies

Regulatory frameworks that promote the adoption of IoT technologies significantly influence the Narrowband-IoT Market. Governments are increasingly recognizing the potential of IoT to enhance operational efficiencies and improve public services. Initiatives aimed at standardizing IoT protocols and ensuring secure data transmission are being implemented. For instance, policies that encourage the deployment of Narrowband-IoT networks can facilitate the integration of smart city solutions, which are expected to grow at a compound annual growth rate of over 20% in the coming years. Such regulatory support not only fosters innovation but also creates a conducive environment for the expansion of Narrowband-IoT applications.