Urbanization Trends

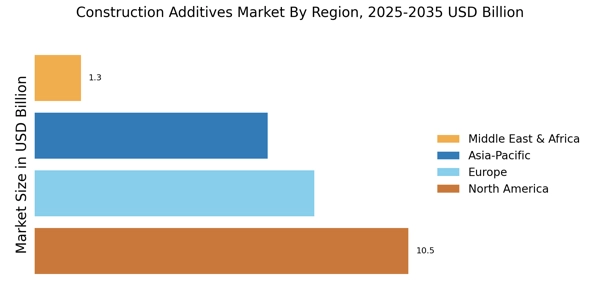

Urbanization trends significantly impact the Construction Additives Market. As populations migrate towards urban areas, the demand for residential and commercial infrastructure escalates. This surge in construction activities necessitates the use of specialized additives that enhance the performance and longevity of building materials. Market data indicates that urban areas are expected to grow by approximately 2 billion people by 2050, leading to an increased need for efficient construction solutions. Consequently, the demand for construction additives that facilitate faster project completion and improved material performance is likely to rise. This trend underscores the importance of the Construction Additives Market in meeting the challenges posed by rapid urbanization.

Regulatory Compliance

Regulatory compliance is a critical driver in the Construction Additives Market. Governments worldwide are implementing stringent regulations regarding construction materials to ensure safety, sustainability, and environmental protection. These regulations often mandate the use of specific additives that enhance the performance and safety of construction materials. For instance, additives that improve fire resistance or reduce emissions during construction are becoming increasingly necessary. Market data reveals that compliance with these regulations can lead to a competitive advantage for manufacturers, as builders seek to align with legal requirements. As such, the Construction Additives Market is likely to experience growth as companies innovate to meet these evolving regulatory standards.

Sustainability Initiatives

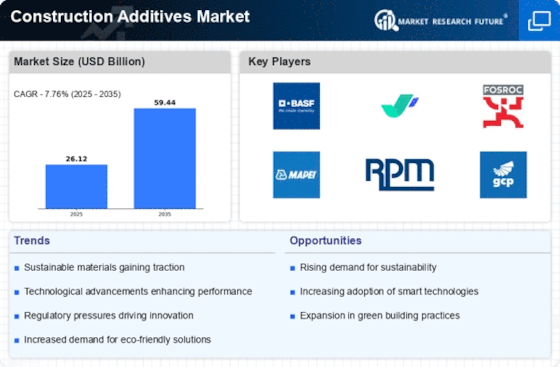

The Construction Additives Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, construction companies are seeking additives that enhance the durability and longevity of structures while minimizing ecological impact. For instance, the demand for eco-friendly additives, such as those derived from natural sources, is on the rise. This shift is reflected in market data, indicating that the segment of sustainable construction materials is projected to grow at a compound annual growth rate of approximately 8% over the next five years. Consequently, manufacturers are innovating to develop products that not only meet regulatory standards but also appeal to environmentally conscious consumers. This trend towards sustainability is likely to drive growth in the Construction Additives Market, as stakeholders prioritize green building practices.

Technological Advancements

Technological advancements play a pivotal role in shaping the Construction Additives Market. Innovations in material science and engineering have led to the development of high-performance additives that improve the properties of concrete and other construction materials. For example, the introduction of nanotechnology in additives has resulted in enhanced strength and durability, which is crucial for modern construction demands. Market data suggests that the segment of high-performance additives is expected to witness a growth rate of around 6% annually. Furthermore, the integration of digital tools for monitoring and optimizing the use of these additives is becoming more prevalent. This technological evolution not only enhances product performance but also streamlines construction processes, thereby contributing to the overall growth of the Construction Additives Market.

Rising Construction Activities

Rising construction activities are a fundamental driver of the Construction Additives Market. With increasing investments in infrastructure development, particularly in emerging economies, the demand for construction additives is surging. This growth is fueled by government initiatives aimed at enhancing public infrastructure, such as roads, bridges, and buildings. Market data indicates that the construction sector is projected to grow at a rate of approximately 5% annually, which directly correlates with the rising demand for additives that improve material performance and durability. As construction projects become more complex, the need for specialized additives that can address specific challenges is likely to increase, further propelling the growth of the Construction Additives Market.