Growth in Automotive Sector

The Lubricant Additives Market is benefiting from the robust growth in the automotive sector, which remains a primary consumer of lubricant additives. With the increasing production of vehicles, particularly in emerging markets, the demand for high-quality lubricants is on the rise. Recent statistics indicate that the automotive industry is expected to grow at a CAGR of around 5% in the coming years, leading to a corresponding increase in the need for effective lubricant additives. These additives play a crucial role in enhancing engine performance, fuel efficiency, and overall vehicle longevity. As automotive manufacturers continue to innovate and improve vehicle technologies, the Lubricant Additives Market is likely to see a surge in demand for specialized additives that cater to the latest engine designs and performance requirements.

Stringent Environmental Regulations

The Lubricant Additives Market is significantly influenced by stringent environmental regulations aimed at reducing emissions and promoting sustainability. Governments across various regions are implementing regulations that mandate the use of eco-friendly lubricants, which in turn necessitates the development of additives that comply with these standards. For instance, regulations such as the European Union's REACH and the U.S. EPA's guidelines are pushing manufacturers to formulate lubricants with lower environmental impact. This shift is expected to drive the demand for biodegradable and non-toxic additives, fostering innovation within the industry. As a result, companies are investing in research and development to create sustainable solutions that not only meet regulatory requirements but also appeal to environmentally conscious consumers. The Lubricant Additives Market is thus poised for growth as it adapts to these evolving regulatory landscapes.

Increasing Focus on Energy Efficiency

The Lubricant Additives Market is increasingly focused on energy efficiency, driven by the need to reduce operational costs and environmental impact. Industries are actively seeking lubricants that not only perform well but also contribute to energy savings. This trend is particularly evident in sectors such as manufacturing and transportation, where energy consumption is a critical concern. Recent analyses suggest that the adoption of energy-efficient lubricants can lead to reductions in energy usage by up to 10%, making them an attractive option for businesses looking to optimize their operations. As a result, the demand for lubricant additives that enhance the energy efficiency of lubricants is expected to rise. This focus on energy efficiency is likely to propel the Lubricant Additives Market forward, as companies innovate to meet these growing demands.

Rising Demand for High-Performance Lubricants

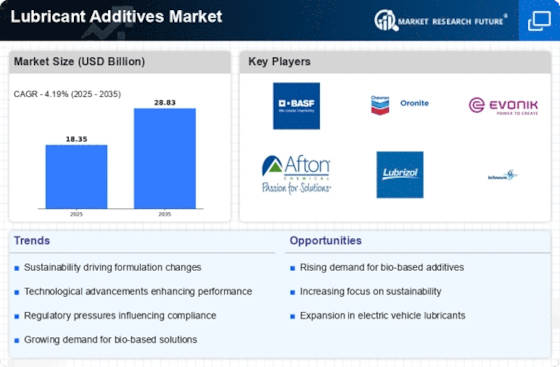

The Lubricant Additives Market is experiencing a notable increase in demand for high-performance lubricants, driven by the need for enhanced efficiency and longevity in various applications. Industries such as automotive, aerospace, and manufacturing are increasingly adopting advanced lubricants that require specialized additives to improve performance characteristics. According to recent data, the demand for high-performance lubricants is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next few years. This trend indicates a shift towards formulations that offer superior thermal stability, reduced friction, and improved wear protection, thereby propelling the growth of the lubricant additives sector. As manufacturers strive to meet these evolving requirements, the Lubricant Additives Market is likely to witness innovations in additive technologies that cater to these high-performance needs.

Technological Innovations in Additive Formulations

The Lubricant Additives Market is witnessing a wave of technological innovations that are transforming additive formulations. Advances in chemistry and materials science are enabling the development of new additives that enhance the performance and efficiency of lubricants. Innovations such as nanotechnology and the use of synthetic base oils are becoming increasingly prevalent, allowing for the creation of additives that provide superior protection against wear and oxidation. This trend is expected to drive the growth of the lubricant additives market, as manufacturers seek to differentiate their products in a competitive landscape. Furthermore, the integration of smart technologies in lubricant formulations is likely to enhance monitoring and performance tracking, providing additional value to consumers. As these technological advancements continue to evolve, the Lubricant Additives Market is positioned for significant growth and transformation.