Sustainability Initiatives

The Composite Materials Market is experiencing a notable shift towards sustainability initiatives. Manufacturers are increasingly focusing on eco-friendly materials and processes to meet regulatory requirements and consumer preferences. This trend is driven by the rising awareness of environmental issues and the need for sustainable practices across various sectors. For instance, the use of bio-based composites is gaining traction, as they offer reduced carbon footprints compared to traditional materials. The market for bio-composites is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This shift not only enhances the appeal of composite materials but also aligns with global sustainability goals, thereby driving growth in the Composite Materials Market.

Technological Advancements

Technological advancements play a crucial role in shaping the Composite Materials Market. Innovations in manufacturing processes, such as 3D printing and automated fiber placement, are enhancing the efficiency and precision of composite production. These technologies enable the creation of complex geometries and lightweight structures, which are particularly beneficial in industries like aerospace and automotive. The integration of advanced materials, such as carbon fiber and aramid fiber, is also contributing to the performance enhancements of composite products. As a result, the market is witnessing an increase in applications across various sectors, with the aerospace segment alone projected to account for a substantial share of the Composite Materials Market. This continuous evolution in technology is likely to drive further growth and diversification in the market.

Regulatory Support and Standards

Regulatory support and the establishment of standards are pivotal drivers in the Composite Materials Market. Governments are increasingly implementing regulations that promote the use of advanced materials in various applications, particularly in aerospace, automotive, and construction. These regulations often focus on safety, performance, and environmental impact, encouraging manufacturers to adopt composite materials that meet stringent criteria. Additionally, the development of industry standards facilitates the integration of composites into mainstream applications, thereby enhancing their acceptance. For example, the aerospace sector has specific certification requirements for composite materials, which, when met, can lead to increased market opportunities. This regulatory landscape is likely to foster innovation and growth within the Composite Materials Market.

Growing Demand in Emerging Markets

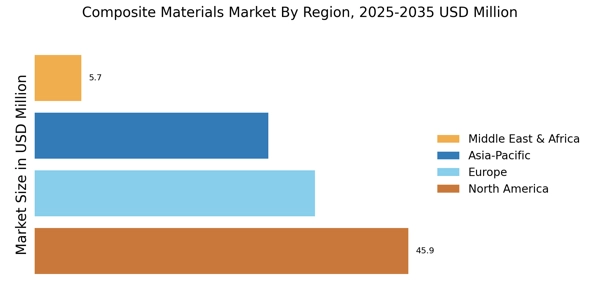

The Composite Materials Market is witnessing a surge in demand from emerging markets, where industrialization and urbanization are accelerating. Countries in Asia-Pacific and Latin America are increasingly adopting composite materials in construction, automotive, and consumer goods sectors. This trend is fueled by the need for lightweight, durable, and cost-effective materials that can enhance product performance. For instance, the automotive industry in these regions is shifting towards composites to improve fuel efficiency and reduce emissions. Market data indicates that the Asia-Pacific region is expected to dominate the Composite Materials Market, with a projected market share of over 40% by 2026. This growing demand from emerging markets presents significant opportunities for manufacturers and suppliers in the Composite Materials Market.

Rising Investment in Research and Development

Rising investment in research and development is a significant driver of the Composite Materials Market. Companies are allocating substantial resources to innovate and improve composite materials, focusing on enhancing their properties and expanding their applications. This investment is crucial for developing next-generation composites that offer superior performance, such as increased strength-to-weight ratios and improved thermal stability. Furthermore, collaborations between industry players and research institutions are becoming more common, leading to breakthroughs in material science. Market analysis suggests that the R&D expenditure in the composite materials sector is expected to increase by approximately 15% over the next five years. This focus on innovation is likely to propel the Composite Materials Market forward, creating new opportunities and applications.