Advancements in Imaging Technology

Technological advancements are significantly influencing the commercial satellite imaging Market. Innovations in imaging technology, such as high-resolution sensors and multispectral imaging, are enhancing the quality and accuracy of satellite data. These advancements enable more detailed analysis and interpretation of geographical features, which is crucial for applications in urban planning and resource management. The introduction of small satellites, or CubeSats, has also reduced costs and increased accessibility to satellite imagery. As a result, the market is expected to witness a substantial increase in the number of satellite launches, further driving growth and expanding the range of available data.

Government Initiatives and Investments

Government initiatives play a pivotal role in propelling the Commercial Satellite Imaging Market forward. Numerous governments are investing in satellite technology to bolster national security, disaster management, and environmental monitoring. For example, the United States has allocated substantial funding for satellite programs aimed at improving climate change monitoring and disaster response capabilities. Such investments not only enhance the capabilities of satellite imaging but also stimulate market growth. The increasing collaboration between public and private sectors further indicates a robust future for the industry, as governments seek to leverage commercial satellite data for public benefit.

Growing Applications in Various Industries

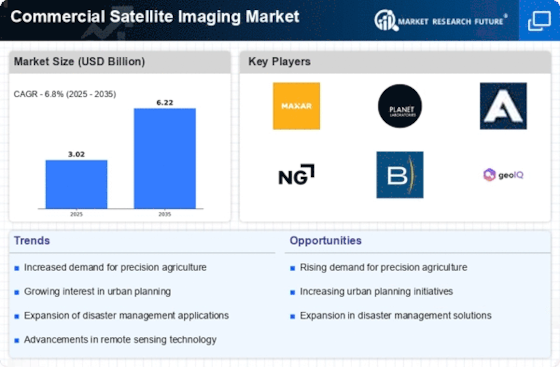

The Commercial Satellite Imaging Market is experiencing a surge in demand due to its diverse applications across multiple sectors. Industries such as agriculture, urban planning, and environmental monitoring increasingly rely on satellite imagery for data-driven decision-making. For instance, in agriculture, satellite imaging assists in precision farming, enabling farmers to optimize crop yields and manage resources efficiently. The market is projected to reach a valuation of approximately 5 billion USD by 2026, reflecting a compound annual growth rate of around 15%. This growth is indicative of the expanding recognition of satellite imagery as a vital tool for enhancing operational efficiency and strategic planning across various industries.

Rising Demand for Environmental Monitoring

The increasing focus on environmental sustainability is driving the Commercial Satellite Imaging Market. Organizations and governments are utilizing satellite imagery to monitor deforestation, track wildlife, and assess the impacts of climate change. This demand for environmental monitoring is expected to grow, as stakeholders seek to implement effective conservation strategies. The market for environmental satellite imaging is projected to expand significantly, with estimates suggesting a growth rate of over 12% annually. This trend underscores the critical role that satellite imagery plays in addressing environmental challenges and promoting sustainable practices.

Integration of Artificial Intelligence and Big Data

The integration of artificial intelligence (AI) and big data analytics into the Commercial Satellite Imaging Market is transforming how satellite data is processed and utilized. AI algorithms enhance the ability to analyze vast amounts of satellite imagery, enabling quicker and more accurate insights. This integration allows for real-time monitoring and predictive analytics, which are invaluable for sectors such as agriculture, urban development, and disaster management. As organizations increasingly adopt AI-driven solutions, the demand for satellite imagery is likely to rise, further propelling market growth. The synergy between satellite imaging and advanced analytics is expected to redefine industry standards and capabilities.