Emergence of New Launch Providers

The commercial satellite-launch-service market is witnessing the emergence of new launch providers, which is reshaping the competitive landscape. Startups and established companies are entering the market with innovative launch solutions, often focusing on cost efficiency and rapid deployment. This influx of new players is expected to increase the number of available launch options, potentially lowering prices for customers. As of 2025, the number of active launch providers in the US is projected to reach over 20, indicating a robust and dynamic commercial satellite-launch-service market.

Expansion of Space-Based Internet

The commercial satellite-launch-service market is witnessing a transformative shift due to the expansion of space-based internet services. Companies like SpaceX and OneWeb are actively deploying large constellations of satellites to provide global internet coverage. This trend is anticipated to create a substantial increase in launch opportunities, with estimates suggesting that over 10,000 satellites may be launched in the next decade to support these initiatives. The potential for high-speed internet access in remote areas is driving investments and partnerships, thereby enhancing the commercial satellite-launch-service market.

Growing Demand for Satellite Services

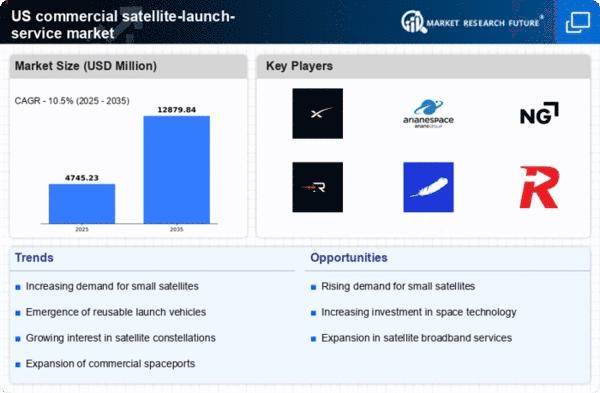

The commercial satellite-launch-service market is experiencing a surge in demand for satellite services, driven by the increasing need for communication, Earth observation, and data analytics. As businesses and governments seek to leverage satellite technology for various applications, the market is projected to grow significantly. In 2025, the demand for satellite launches is expected to reach approximately 1,000 launches annually, reflecting a growth rate of around 15% from previous years. This growing demand is likely to stimulate competition among launch service providers, leading to innovations and cost reductions in the commercial satellite-launch-service market.

Increased Investment in Space Exploration

The commercial satellite-launch-service market is benefiting from heightened investment in space exploration initiatives. Both private and public sectors are allocating substantial resources to explore new frontiers, including lunar missions and Mars exploration. In 2025, it is estimated that investment in space exploration will exceed $30 billion, with a significant portion directed towards launch services. This influx of capital is likely to foster innovation and improve the capabilities of launch vehicles, thereby enhancing the commercial satellite-launch-service market's growth prospects.

Regulatory Support for Commercial Space Activities

The commercial satellite-launch-service market is experiencing favorable regulatory support from government agencies, which is crucial for its growth. The Federal Aviation Administration (FAA) and other regulatory bodies are streamlining the licensing process for launch operations, thereby reducing barriers to entry for new companies. This regulatory environment is expected to encourage innovation and investment in the sector. By 2025, it is anticipated that the number of licensed commercial launches will increase by 25%, reflecting the positive impact of regulatory support on the commercial satellite-launch-service market.