Regulatory Compliance

Regulatory compliance is a significant driver within the Global Industrial Institutional Cleaning Chemicals Market Industry. Governments worldwide are implementing stringent regulations regarding the use of chemicals in cleaning products, emphasizing safety and environmental protection. Compliance with these regulations is essential for manufacturers to maintain market access and consumer trust. As a result, companies are investing in research and development to create formulations that meet regulatory standards while ensuring effectiveness. This focus on compliance not only fosters innovation but also contributes to the overall growth of the market, as businesses seek to align their products with evolving legal requirements.

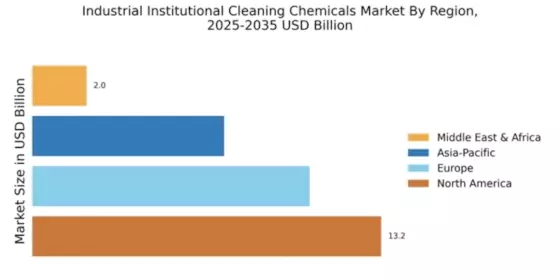

Market Growth Projections

The Global Industrial Institutional Cleaning Chemicals Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 3.73% from 2025 to 2035. This growth trajectory reflects the increasing demand for cleaning chemicals across various sectors, including healthcare, education, and hospitality. As organizations continue to prioritize hygiene and cleanliness, the market is expected to expand significantly, reaching an estimated 49.3 USD Billion by 2035. This upward trend underscores the importance of innovation and adaptation within the industry, as manufacturers strive to meet the evolving needs of consumers and regulatory standards.

Sustainability Initiatives

Sustainability initiatives are becoming increasingly pivotal within the Global Industrial Institutional Cleaning Chemicals Market Industry. Companies are actively seeking eco-friendly cleaning solutions that minimize environmental impact while maintaining efficacy. This shift towards sustainable practices is evidenced by the growing adoption of biodegradable and non-toxic cleaning agents. As consumers and businesses alike become more environmentally conscious, the demand for green cleaning products is expected to rise significantly. This trend not only aligns with global sustainability goals but also opens new avenues for manufacturers to innovate and differentiate their offerings in a competitive market.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Industrial Institutional Cleaning Chemicals Market Industry. Innovations in formulation chemistry and application techniques are leading to the development of more effective and efficient cleaning products. For instance, the introduction of smart cleaning technologies, such as automated dispensing systems and IoT-enabled devices, enhances the precision and consistency of cleaning processes. These advancements not only improve operational efficiency but also reduce waste and costs for end-users. As the market evolves, companies that leverage technology to enhance product performance are likely to gain a competitive edge.

Growth of the Hospitality Sector

The growth of the hospitality sector is a key factor influencing the Global Industrial Institutional Cleaning Chemicals Market Industry. As travel and tourism continue to rebound, hotels, restaurants, and other hospitality establishments are increasingly prioritizing cleanliness and hygiene to attract customers. This trend is driving the demand for specialized cleaning chemicals that cater to the unique needs of the hospitality industry. With projections indicating that the market could reach 49.3 USD Billion by 2035, the hospitality sector's emphasis on maintaining high standards of cleanliness presents significant opportunities for manufacturers to expand their product offerings and market reach.

Rising Demand for Hygiene Products

The Global Industrial Institutional Cleaning Chemicals Market Industry is experiencing a notable increase in demand for hygiene products across various sectors. This trend is driven by heightened awareness of cleanliness and sanitation in workplaces, educational institutions, and healthcare facilities. As organizations prioritize health and safety, the market is projected to reach 33.0 USD Billion in 2024. This surge in demand is likely to propel the growth of cleaning chemicals that meet stringent regulatory standards, ensuring effective disinfection and sanitation. Consequently, manufacturers are innovating to develop products that cater to these evolving needs, thereby enhancing their market presence.