Regulatory Compliance

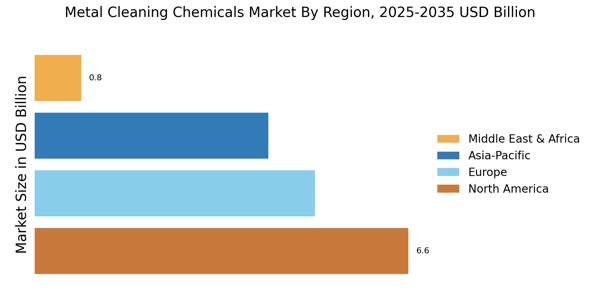

Regulatory compliance is a significant driver influencing the Metal Cleaning Chemicals Market. Governments and environmental agencies have established stringent regulations regarding the use of hazardous substances in industrial cleaning processes. Companies are compelled to adopt safer and more environmentally friendly cleaning agents to comply with these regulations. The market for metal cleaning chemicals is projected to grow as industries seek compliant solutions that minimize environmental impact. For instance, the introduction of regulations such as REACH in Europe has prompted manufacturers to innovate and develop eco-friendly cleaning products. This regulatory landscape indicates that compliance will continue to shape the Metal Cleaning Chemicals Market, driving demand for sustainable alternatives.

Technological Innovations

Technological innovations are reshaping the Metal Cleaning Chemicals Market by introducing advanced cleaning solutions that enhance efficiency and effectiveness. Innovations such as ultrasonic cleaning and automated cleaning systems are gaining traction, allowing for more thorough and faster cleaning processes. These technologies not only improve cleaning outcomes but also reduce the consumption of chemicals and water, aligning with sustainability goals. The market is witnessing a shift towards smart cleaning solutions that integrate IoT technology, enabling real-time monitoring and optimization of cleaning processes. This trend suggests that as technology continues to evolve, the Metal Cleaning Chemicals Market will likely adapt, leading to increased adoption of innovative cleaning methods.

Increasing Industrialization

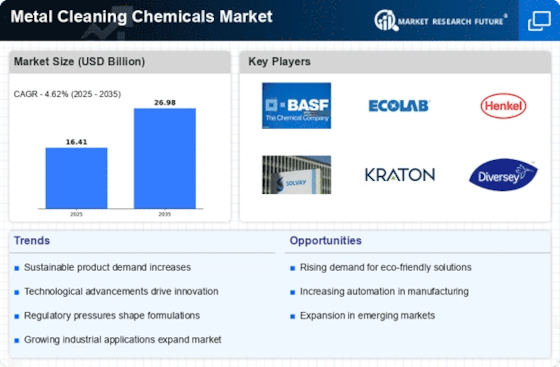

The rise in industrialization across various sectors appears to be a primary driver for the Metal Cleaning Chemicals Market. As manufacturing processes expand, the demand for effective cleaning solutions to maintain machinery and equipment becomes critical. Industries such as automotive, aerospace, and electronics are particularly reliant on metal cleaning chemicals to ensure operational efficiency and product quality. According to recent data, the manufacturing sector has shown a steady growth rate of approximately 3.5% annually, which correlates with the increasing consumption of metal cleaning chemicals. This trend suggests that as industries continue to grow, the Metal Cleaning Chemicals Market will likely experience a corresponding increase in demand.

Growing Demand from Automotive Sector

The automotive sector is a major contributor to the Metal Cleaning Chemicals Market, driven by the need for high-quality cleaning solutions to maintain vehicle components. As the automotive industry evolves with the introduction of electric vehicles and advanced manufacturing techniques, the demand for specialized cleaning chemicals is expected to rise. Data indicates that the automotive sector accounts for a substantial portion of the overall demand for metal cleaning chemicals, with projections suggesting a growth rate of around 4% in the coming years. This growth is likely to be fueled by the increasing complexity of automotive parts and the necessity for precision cleaning to ensure product reliability and performance.

Rising Awareness of Health and Safety

Rising awareness of health and safety standards is significantly influencing the Metal Cleaning Chemicals Market. As industries prioritize worker safety and health, there is a growing demand for cleaning chemicals that are less toxic and safer for use. This shift is prompting manufacturers to develop formulations that minimize health risks while maintaining cleaning efficacy. The market is responding to this trend by offering a range of safer alternatives, which are increasingly preferred by companies aiming to enhance workplace safety. The emphasis on health and safety is likely to drive innovation and growth within the Metal Cleaning Chemicals Market, as businesses seek to align with best practices and regulatory requirements.