Investment in Energy Infrastructure

Investment in energy infrastructure is crucial for the advancement of the Clean Energy Technology Market. As countries transition to cleaner energy sources, there is a pressing need to upgrade existing energy infrastructure to accommodate renewable technologies. This includes the development of smart grids, energy storage systems, and charging stations for electric vehicles. In 2025, it is projected that investments in energy infrastructure will reach unprecedented levels, with billions allocated to enhance grid reliability and integrate renewable sources. Such investments not only facilitate the deployment of clean energy technologies but also create jobs and stimulate economic growth. The Clean Energy Technology Market stands to gain significantly from these infrastructure developments, which are essential for a sustainable energy future.

Regulatory Support for Clean Energy

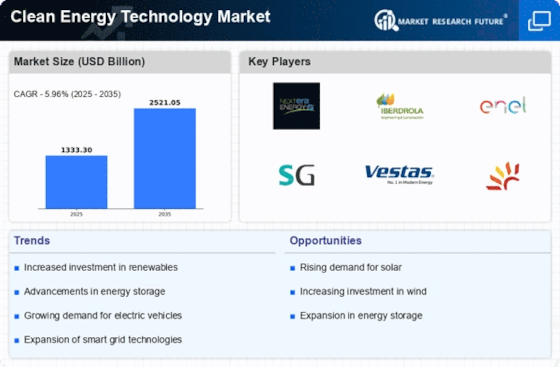

The Clean Energy Technology Market benefits from robust regulatory frameworks that promote renewable energy adoption. Governments worldwide are implementing policies that incentivize clean energy investments, such as tax credits and subsidies. For instance, in 2025, several countries have set ambitious targets for reducing greenhouse gas emissions, which has led to a surge in clean energy projects. This regulatory support not only encourages private sector investment but also fosters innovation in clean technologies. As a result, the Clean Energy Technology Market is experiencing accelerated growth, with projections indicating a compound annual growth rate of over 10% in the coming years. The alignment of regulatory frameworks with market needs appears to create a conducive environment for the expansion of clean energy solutions.

Technological Innovations in Renewable Energy

Technological advancements play a pivotal role in shaping the Clean Energy Technology Market. Innovations in solar, wind, and hydroelectric technologies have significantly improved efficiency and reduced costs. For example, the cost of solar photovoltaic systems has decreased by approximately 80% over the past decade, making solar energy more accessible. Furthermore, advancements in wind turbine design have increased energy capture, enhancing the viability of wind projects. These innovations not only drive down the cost of clean energy but also expand the range of applications for renewable technologies. As a result, the Clean Energy Technology Market is poised for substantial growth, with new technologies emerging that could further disrupt traditional energy paradigms.

Growing Consumer Demand for Sustainable Solutions

Consumer preferences are shifting towards sustainable energy solutions, which is a key driver for the Clean Energy Technology Market. As awareness of climate change and environmental issues increases, consumers are actively seeking cleaner energy options. This trend is reflected in the rising demand for electric vehicles and energy-efficient appliances. In 2025, it is estimated that the market for electric vehicles alone will exceed 10 million units sold annually, indicating a strong consumer shift. This growing demand encourages companies to invest in clean energy technologies, thereby stimulating market growth. The Clean Energy Technology Market is likely to benefit from this consumer-driven momentum, as businesses adapt to meet the evolving expectations of environmentally conscious consumers.

International Collaboration on Clean Energy Initiatives

International collaboration is emerging as a vital driver for the Clean Energy Technology Market. Countries are increasingly recognizing the need to work together to address climate change and promote clean energy solutions. Initiatives such as international agreements and partnerships facilitate knowledge sharing, technology transfer, and joint investments in clean energy projects. In 2025, several multinational agreements are expected to be established, focusing on renewable energy development and carbon reduction strategies. This collaborative approach not only accelerates the deployment of clean technologies but also enhances the global competitiveness of participating nations. The Clean Energy Technology Market is likely to thrive as countries leverage collective resources and expertise to advance their clean energy agendas.