Leading industry players are investing a lot of money in R&D to expand their product offerings, which will spur further growth in the clean-label ingredients market. In addition, market participants are launching new products, entering into contracts, acquiring companies, increasing investments, and working with other organizations, among other significant market developments, to expand their footprint. To grow and thrive in a market that is becoming more and more competitive, businesses in the clean-label ingredients sector must offer affordable products.

Manufacturing locally to cut operational costs is one of the main business methods used by manufacturers in the clean-label ingredients industry to benefit customers and develop the market sector. Some of the biggest advantages to medicine in recent years have come from the clean-label ingredients sector. Major players in the clean-label ingredients market, including Cargill Inc., Archer Daniels Midland Corporation, Koninklijke DSM N.V., Republic of Ireland, Ingredion Incorporated, Tate & Lyle PLC, and others, are seeking to increase market demand by funding R&D initiatives.

Cargill, Inc. is a privately held American multinational food company with headquarters in Minnetonka, Minnesota, and was established in Wilmington, Delaware. It was established in 1865 and, in terms of income, is the biggest privately held corporation in the US. As of 2015, if it were a publicly traded firm, it would be ranked number 15 on the Fortune 500, following McKesson and before AT&T. Concerns about the environment, human rights, finances, and other ethical issues have repeatedly been raised against Cargill.

In October 2021, Cargill Corporation introduced SimPure rice flour, a clean-label bulking ingredient with a similar taste, texture, and functioning as maltodextrin. The new ingredient was officially presented by the firm at the SupplySide West trade exhibition. The major goal of this innovation was to broaden the company's product offering.

Ingredion Incorporated is a American ingredient provider based in Westchester, Illinois, that primarily manufactures starches, non-GMO sweeteners, stevia, and pea protein. Corn, tapioca, potatoes, plant-based stevia, cereals, fruits, gums, and other vegetables are processed into ingredients for the food, beverage, brewing, and pharmaceutical industries, as well as many other industrial sectors. It employs around 12,000 people across 44 locations and serves consumers in over 120 countries.

In April Ingredion introduced two functional native rice starches, specifically engineered to increase colour and flavour release.

According to the company, natural flavours and colours of applications can shine through even in white products.

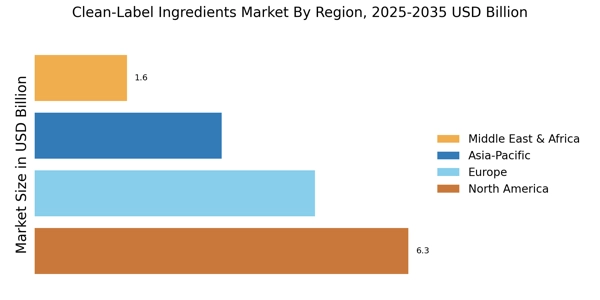

In terms of clean label ingredients market size, the sector has seen significant growth worldwide, supported by rising consumer demand, regulatory encouragement for cleaner formulations, and investment in research and development. Market size metrics reflect not only current sales and adoption rates but also strong future projections as clean label becomes a standard expectation rather than a niche trend. Analysts emphasize that clean label ingredient market size is influenced by product launches, geographic expansion, and increased use in mainstream food processing.